Risk and business cannot be separated! For an entrepreneur, the possibility of a loss is as real as the possibility of profitability; what lies in between the two is risk. In simple terms, the risk is the possibility of loss for a business, with financial implications. There are risks that are avoidable and risks that need to be better managed to reduce the likelihood of negative consequences.

Basic Elements of Risk Management

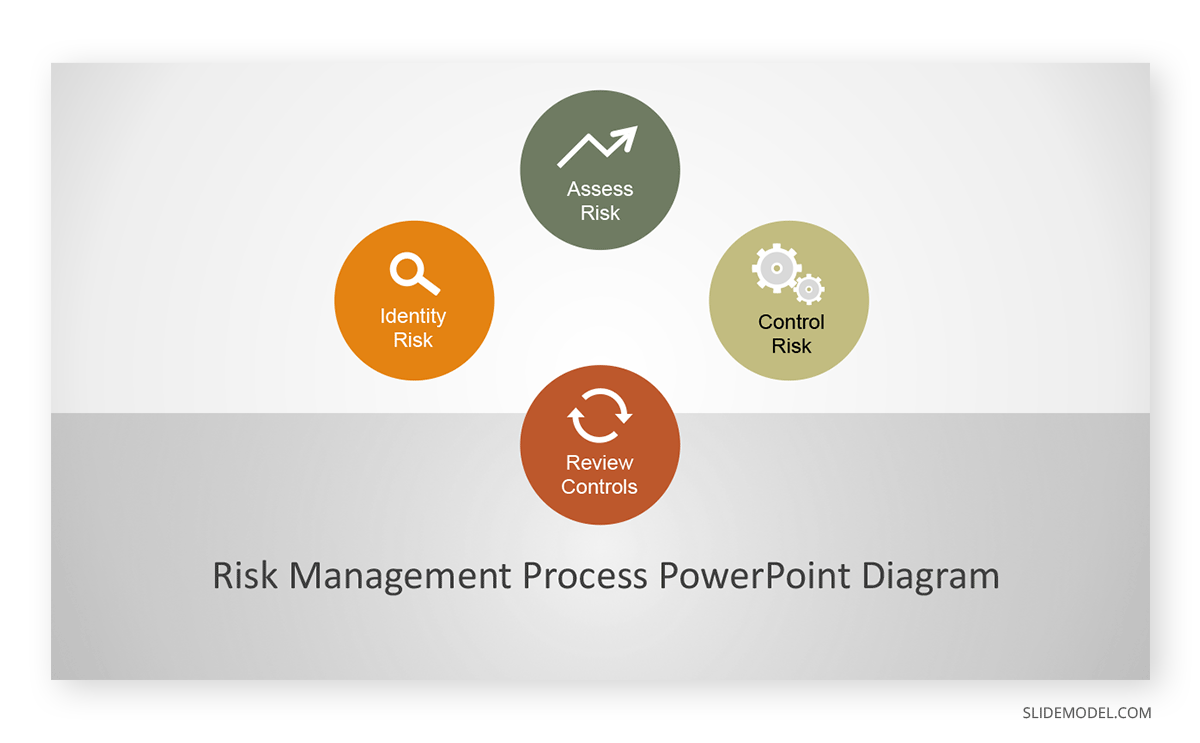

Risk management is the identification, assessment, and controlling of risks. Businesses around the world plan and spend a significant amount of money in managing risks. However, risk management has implications beyond business. Risk management is applicable for businesses and disaster management and can even be used by an individual at the household level. The latter can be a form of financial management, retirement-related risks, and identification of financial shocks that can affect a household.

Risk management broadly has five basic elements, covering the structure of how it can be incorporated for anticipating and controlling risks.

1. Identify Threats

In order to anticipate and manage risks, one must first identify what might be deemed as a risk. For a business, it can include the possibility of financial loss, an injury to an employee, the possibility of a lawsuit, accidents affecting customers, etc. These risks can arise due to a number of factors, be it economic conditions of a country, competition from competitors, lack of safety measures at the workplace for employees, faulty products, and the like.

2. Assess Vulnerability of Critical Assets

The next step includes an evaluation and assessment of risks. This is to identify the vulnerability of critical assets due to the risk. For example, if there is a production process that can lead to an employee’s injury or death, there seems to be a high probability of such an accident occurring. Such a process needs to be changed or replaced.

3. Determine the Threat the Risk Poses

Different risks can pose different types of threats. An injury caused due to a hazardous production process can lead to a lawsuit by the employee, cause reputation damage, and might even lead to a decline in sales due to bad reputation.

4. Reducing Risks

There are several ways that businesses can reduce risks. If a production process has the potential to cause harm, it might be worth revising how the process is carried out or finding alternative methods for performing certain tasks to make the process safe. There might even be a need for safety equipment or machinery and regular equipment inspection and maintenance that can help manage such a risk in a better way by reducing the probability of an accident. Some risks however can be hard to reduce. This might include accounting for an economic meltdown, economic policy changes due to a change of government in a country, or viz majors like the COVID-19 pandemic or an unforeseen natural disaster.

5. Risk Reduction Measures

Risks can be categorized, (e.g., low, medium, or high). It isn’t necessary for a business to try to manage all types of risks, since the possibility of some risks might be negligible, and committing resources for them might be very expensive. Risk reduction is a process that cannot be viewed in isolation. Organizations need to perpetually monitor risks and account for course correction if and when necessary.

Managing Different Types of Risks

Risk management entails various types of strategies, such as risk reduction, risk avoidance, risk sharing, and risk retaining. We covered these strategies in detail in our previous post about risk management and risk assessment. In the section below, we will provide you with examples of different types of risks a business might face and what can be a few ways of managing such risks.

Market Risk

When it comes to imagining risks, investors usually consider the term synonymous with market risk. Market risk is the possibility of investors losing money due to a decrease in the value of their investment. The most common strategy for investors to manage market risk is by diversifying investment portfolios to avoid tying too many assets in a single business entity. Furthermore, buying at various intervals and investing in less correlated investments, such as real estate, bonds, and other commodities can be another method to avoid market risks.

Inflation Risk

Inflation can affect a business in a number of ways. The cost of inputs can suddenly rise, whereas a business engaged in export of goods can find the real value of the currency decline, leading to a loss in selling goods at a previously agreed rate. Similarly, an increase in the price of imports due to a shift in exchange rate can adversely affect the price the business can charge for its products in the local market.

There are a number of ways businesses can manage inflation-related risks, such as by localization of production parts to avoid exchange rate volatility and owing ancillary firms. Likewise, an investor might choose to invest in assets that can offer a real rate of return above inflation. This might include real estate, mineral resources, or government-issued bonds.

Liquidity Risk

You might come across a house that you intend to buy to sell later on. The location of the house might be in an area that has good market value and is likely to increase in the near future. However, how long might it take you to sell the house? Is the property too expensive for an average buyer? Will your assets get tied up for too long after purchasing the property? This is an example of how a liquidity risk can occur. Businesses can end up with assets that are tied up for too long, leading to the risk of owning assets that can be hard to cash out.

A liquidity risk can be avoided by avoiding the purchase of assets that might be difficult to cash out. Some businesses might avoid giving products on credit to local retailers or selling raw material at deferred payments to avoid a liquidity risk.

Longevity Risk

As people receive better healthcare and lifestyles, it is expected that they might live longer. While this is good news, the increase in the lifespan of such individuals means that pensions and policyholders will live longer, leading to a higher payout ratio. Longevity risk is viewed differently by different individuals. For a business, a long lifespan of policyholders or pensioners will lead to an increase in the amount of money they need to pay. Whereas people receiving such benefits will be able to live longer with the assurance of the benefits they have worked hard for.

Many organizations, be it profitable businesses or government-run organizations operating on a loss for several years, have different coping mechanisms for such a risk. Many organizations now hire employees on a contractual basis, whereas pensioners in some cases might be paid out an amount after a ‘plan termination’ by the employer. Some countries might also look to encourage people to work longer and delay social security to rationalize pension plans.

Opportunity Risk

Let’s assume you have a large sum of money placed safely in a safe at home. While the money might appear secure, it might lose value over time due to inflation. You might also run the risk of missing out on a profitable opportunity because you failed to invest in the venture. Businesses can be risk-averse, leading to a competitor taking more of the market share by investing in R&D to improve their product.

An opportunity risk, therefore, requires careful consideration. Businesses might choose to keep a sum for cost overruns, emergency needs or to avoid losing money tied up in assets hard to liquidate while investing the rest to avoid an opportunity risk.

Tax Risk

For any business, taxes, especially an increase in them, can lead to a reduction in profitability and loss of sales due to higher prices for their commodities. There’s also the issue of sales tax compliance as the company expands to new states or countries. For an investor, it is essential to determine which portfolio to invest in, considering the rate of tax applicable in relation to the anticipated rate of return. Some investors might opt for tax-deferred accounts to cope with tax risks, whereas businesses might try to reduce tac risks by investing in offers by the government in products which are less heavily taxed.

Many countries are offering fewer taxes on electric cars to help improve the air quality of cities and reduce the negative implications of cars running on petroleum-based products. Some countries have even announced a ban on petrol and diesel-based vehicles by 2035.

Sequence of Returns Risk

An investor might invest in a portfolio or venture that gives it a return of 5% one year and a loss of 5% the following year. To avoid negative portfolio returns, investors might spend conservatively and account for spending flexibility. An investor might also avoid selling stocks on a loss and use a reserve to fund for a buffer stock to avoid short-term losses due to a sale of stocks at a loss when the chips are down. To have smart investment strategies, start using an all-in-one investment app, which allows you to prevent risks.

Using Different Techniques for Identifying and Presenting Risks

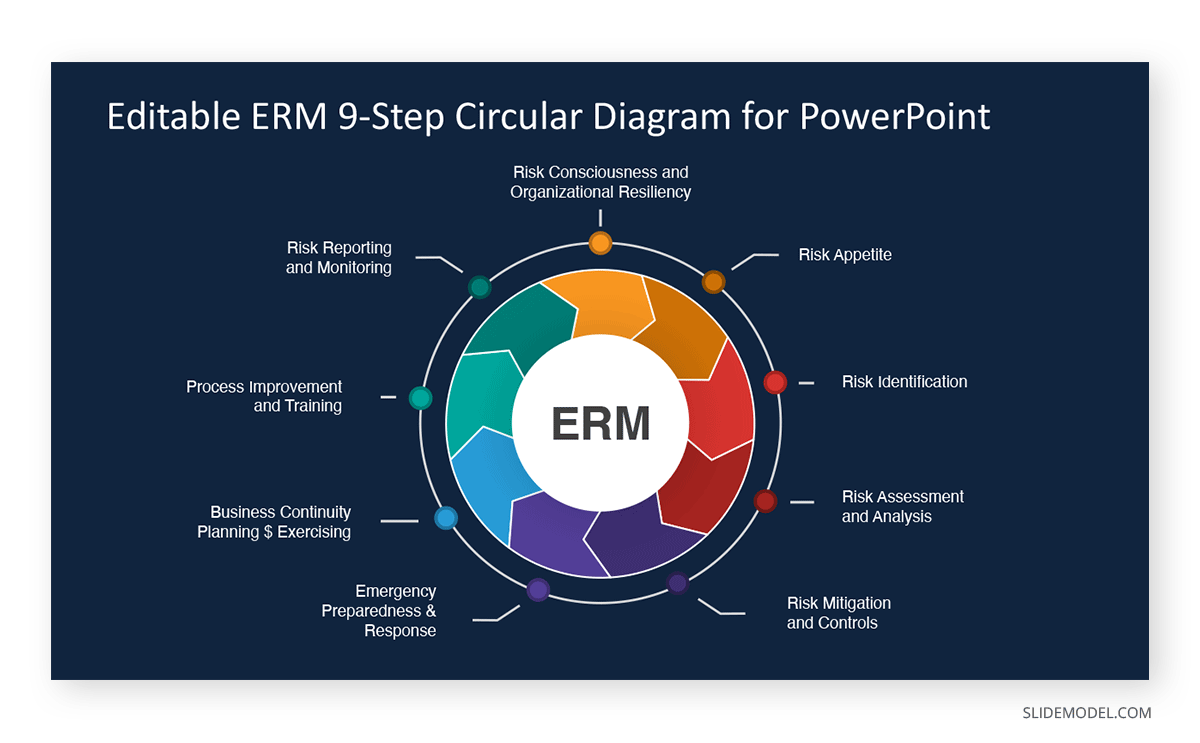

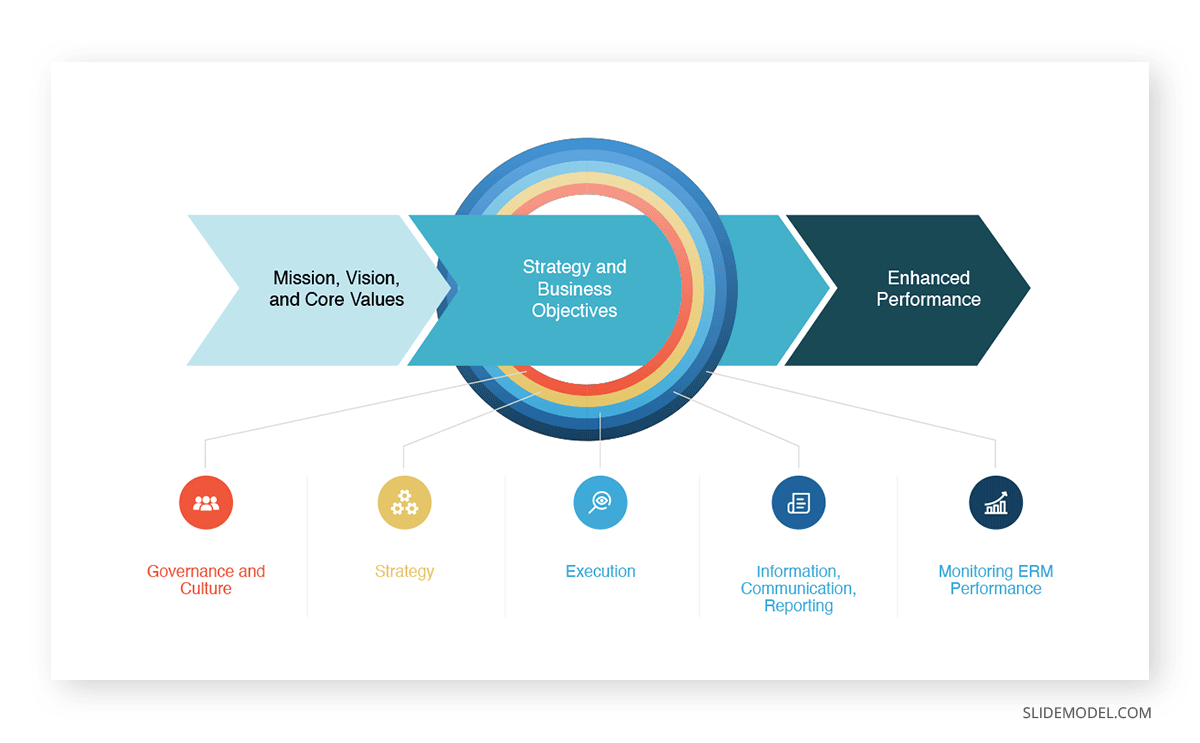

There are a number of techniques that businesses use to identify risks. If you need to create a PowerPoint presentation about risk management, you can use a number of handy templates and techniques listed below.

Risk Matrix

A risk matrix is used during the process of assessing risks to categorize them and determine the possibility of the occurrence of the risks. The matrix can be a very handy mechanism for visually identifying high-priority risks for important management decisions.

RAIDAR Model

RAIDAR model is a risk management model used to assess risks, assumptions, issues, dependencies, action, and repairs. The model can be useful for assessing project risks and for their effective management.

PEST or PESTEL Analysis

A PEST analysis looks at the political-economic, social and technological environment for macro-environmental factors. The analysis is often extended to also include environmental and legal factors, extending the term PEST to PESTEL. This strategic management component is used for the scanning for the aforementioned factors to determine the potential for market growth, decline, and the direction that the business needs to take.

SWOT Analysis

A SWOT Analysis is a famous strategic planning technique used for identifying strengths, weaknesses, opportunities, and threats. Be it a competitor, economic uncertainty, natural disasters, market volatility, or the potential of an opportunity risk, a SWOT analysis can be a handy tool to use in identifying and mitigating risks.

Decision Tree

A decision tree is used to support decisions by placing options and anticipating possible consequences in a tree-like structure. A decision tree can be used by businesses to assess chance events, resource costs, risks, and payoffs.

Final Words

There are risks that a business can account for and manage and risks that remain perpetual. Risks that might be associated with the national economy, a natural disaster, or sudden change in government policy can be hard to account for and need constant monitoring. This is different from risks that can be managed by changing a hazardous production process to a safer alternative or diversification of portfolio to avoid losses.

Risk management is a practice that businesses would ideally do away with if it were ever possible. As distasteful as it might be, it is impossible to avoid anticipating risks for business continuity and managing them, even if it comes with a burden of heavy costs that are sometimes unavoidable.