What is inevitable for any entrepreneur is risk! Without risk, there can be no reward, and at a manageable level of t risk, businesses can achieve success. On the contrary, threats that don’t result in a positive outcome can ruin a business. However, this is not a zero-sum game. Even if a risk turns out to be a wrong business decision, companies can recover from the negative outcome. What is essential to consider for every business or venture is risk analysis and its management. Risk analysis and risk management are critical for businesses and are also used by government and non-profit organizations. In what is to follow, we will provide you with an overview of risk analysis and risk management.

What is Risk Analysis and Risk Management?

Risk can be viewed as either the probability of something going wrong or the probability of turning into reality. Risk analysis is essentially the anticipation and management of risks that may result from an event or action, i.e., the anticipation of risks that a business or venture might face. It is the process of analyzing possible issues that can negatively affect a business initiative or project. Similarly, risk management is the identification, assessment, and control of risks that might affect an organization’s earnings or capital.

Risk Analysis

When performing a risk analysis, one must identify possible threats and then assess the likelihood of those threats materializing. To assess risks, you will need to dig into detailed project plans, financial information, forecasts, etc.

When is Risk Analysis Used?

Organizations use risk analysis at various stages, such as planning, pre-assessment, or launch of a project.

Pre-Assessment

Before the launch of a new project. Risk analysis is used as a pre-assessment tool to determine the feasibility of projects to decide to move forward or abandon them.

Project Planning

When planning a project, an organization might require assessing risks to understand and mitigate.

Improvement and Safety

Risk analysis is also used when improving or managing potential risks at the workplace, such as improving safety procedures.

Changing Market Conditions

You might want a risk analysis when a new competitor enters the market or when market conditions change. For example, imposition of new taxes, currency devaluation, and other factors which might significantly change the market conditions may require risk analysis.

Preparing for Events

Risk analysis is used for the assessment and management of risks at an event. This might range from equipment malfunction to theft, protest from a pressure group, a natural disaster occurring during the event, etc.

How to use Risk Analysis?

Risk analysis requires identifying and estimating risks to back decision making to protect the organization from possible financial, reputational, procedural, technical, structural, natural, and political risks.

Identifying Threats

To analyze risks, you must first identify the different types of risks to plan for them or to understand their likelihood of occurring. When analyzing risks, you can consider various sources which might pose a threat such as:

- Loss of an employee due to death, injury, or other factors

- Loss of supplies, failure to distribute, or loss of access to essential assets leading to an operational crisis

- Damage to customer, employee, or market reputation, resulting in reputational loss

- Failures in the execution of a procedure, lack of control or accountability, fraud or negligence due to procedural issues

- Project-related issues such as delays, budgetary constraints, cost overruns and lack of quality in service delivery

- Financial risks, such as; market fluctuations, changes in interest rates, currency devaluation leading to an increase in the price of inputs and funding constraints

- Technical failure or a technology change can pose a risk. New technology often leads to making many types of businesses obsolete

- A natural disaster, random changes in weather or disease can lead to various risks

- Political uncertainty, change in a political regime or structure, taxes, wars, and other types of risks can be tied to multiple threats due to political changes

- Structural issues which might harm equipment, people, or assets can be threats that might need mitigation. This might include issues related to waste management, safety issues at the workplace, operation of equipment that might malfunction or lead to a hazard, and the like

Threats can be identified using various methods such as a Failure Mode and Effects, SWOT or SOAR Analysis.

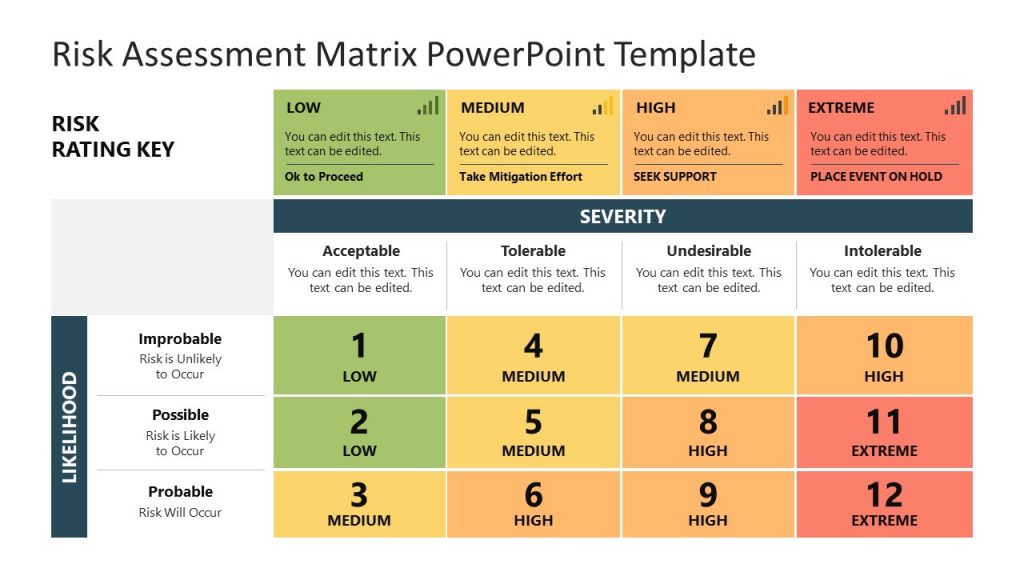

Estimating Risks

Once threats have been identified, it´s important to calculate the possibility of those risks materializing and their potential impact. Estimating risks can be performed by using a simple calculation to assess the risk value:

Risk = Probability x Cost

Example: There is a 50% chance that the government will impose a new tax on an imported item that your business uses as an input for producing product X. This will result in a cost of $600,000 over a year.

0.50 (probability of tax being imposed) x $600,000 (cost of the price increase) = $300,000 (Value of Risk

Risk Management

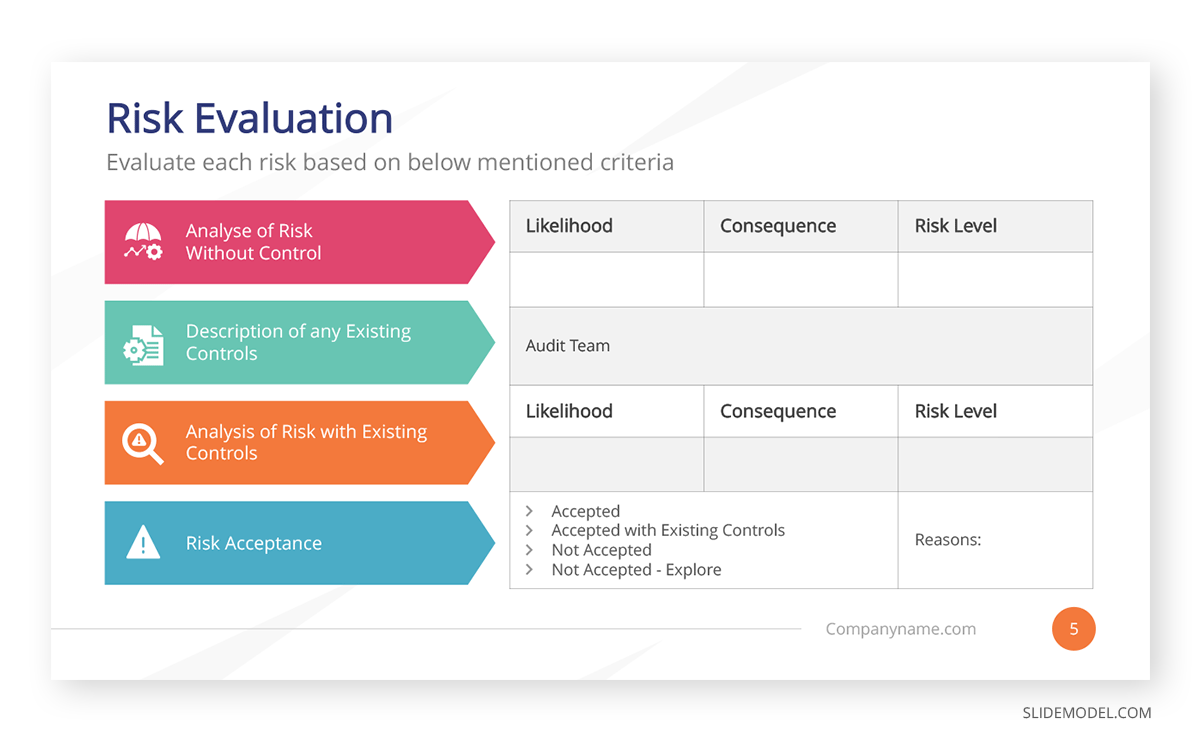

After you have identified risks and assessed their probability of occurring, you need to manage the risks. You will have to either avoid, share or accept the dangers that lie ahead. Furthermore, you will also require making plans to control risks.

Avoiding Risks

While there can be no reward without risks, you might want to avoid some risks altogether. An excellent example of this can be to prevent a business venture for which a risk assessment has shown less promise than previously anticipated.

Example: Company X, a car manufacturer which makes high-end cars, wants to enter a new market by investing in assembling cars in Country A. However, after assessing the local market, the carmaker determines that country A people have low purchasing power. The demand for high-end vehicles is saturated and limited to a small portion of the population. Furthermore, the government has imposed new taxes on the car industry, and the currency of Country A has devalued 50% in a single year, leading to a rise in the cost of inputs. The additional assessment shows that the condition is likely to deteriorate in the wake of a devaluing currency and other taxes expected to be imposed in the next fiscal year. In such a case, it might not be feasible for Company X to invest in Country A.

Sharing Risks

You can share risks to reduce their impact and improve your chances of potential gains.

Example: Company X wants to enter the car market in Country A to sell high-end cars by locally assembling them but the market conditions don’t seem very conducive. However, Company Y is already selling cars in Country A and manufactures cars using 70% local inputs instead of assembling cars. Company Y is looking for an investor to expand the business. Instead of making local cars, Company X can invest in Company Y and manufacture high-end cars locally by entering a joint venture. In this case, Company X can share the risk with Company Y.

Accepting Risks

Accepting risk is sometimes the only option. This might be when the risk cannot be mitigated when the threat can lead to a potential gain worth the risk or when insuring costs are less than the cost of the loss. Organizations might conduct various types of analysis, such as risk analysis, impact analysis and make a contingency plan before accepting the risk.

Example: Company X might invest in Country A despite uncertainties in the exchange rate, taxation, and a decline in consumer interest if it can ensure low-cost production and offer its high-end cars at a rate below the competition. Company X might do this by buying inputs locally, getting tax concessions from the government, attracting local investment, etc. Sometimes governments might introduce measures to attract investment for new companies by offering tax concessions, reducing duties on imported inputs, subsidizing industries, and offering low energy rates for reducing the cost of production. Such a measure might reduce the risk for Company X and encourage investment. On the contrary, if Company X had already invested in Country A before the volatile market conditions, it might require accepting the risk. In such a case, Company X might want to stay in the market a bit longer to manage the risk.

Controlling Risks

There can be various preventive methods used to control risks. You can also detect processes and possible issues which might occur in the future.

Example: Company X invests in Country A and sets up plants to manufacture and high-end cars. However, the government of Country A increases taxes, import duties on inputs, and the country’s currency devalues by 50%. However, Company X already took preventive measures by relying only 10% on imported inputs and lobbied with car manufacturers to reverse the new taxes. Since Company X had already analyzed such tax reversals in the past due to significant industry pressure, the industry fuels thousands of jobs.

How to Create a Presentation for Risk Analysis and Risk Management?

Running people through only a few insights in a PowerPoint presentation of your risk analysis or risk management plan is not the best way to go. Your audience needs to understand how those risks can affect expected results and how they can make decisions around the findings. Have in mind also if your presentation is for who approves a project, the ones who are planning it, or even if they are a team in charge of preventing satellite events that might affect it in the long run.

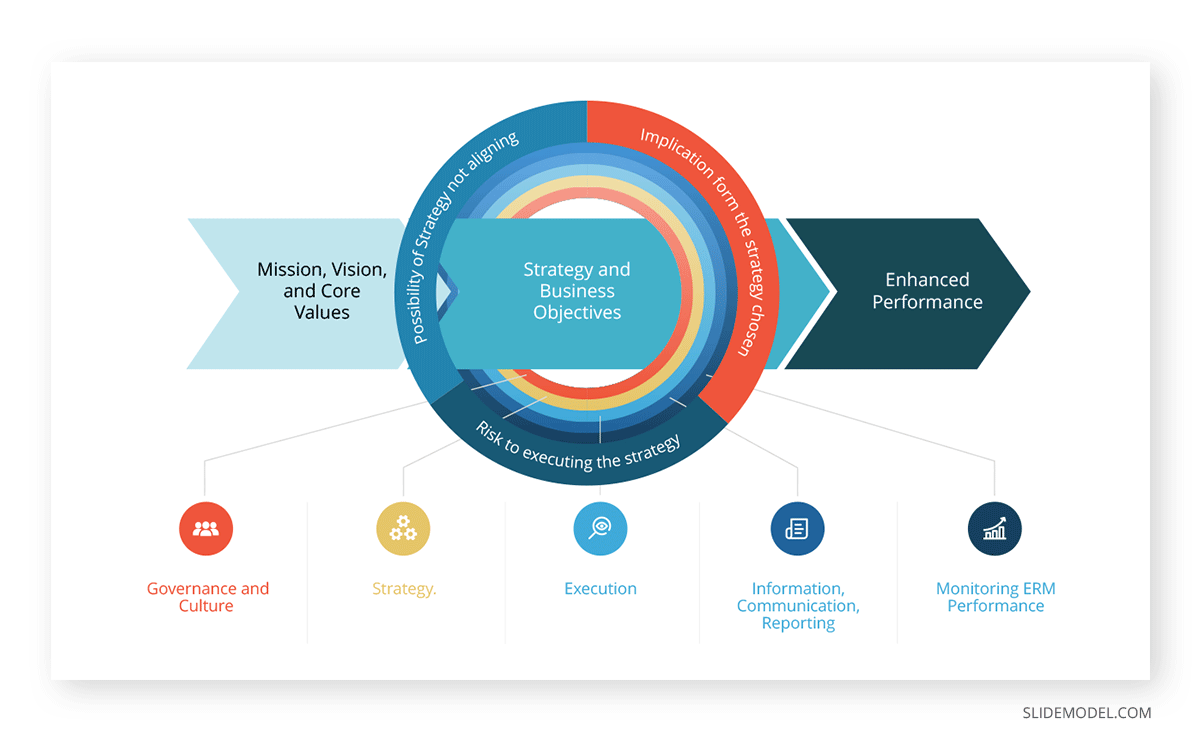

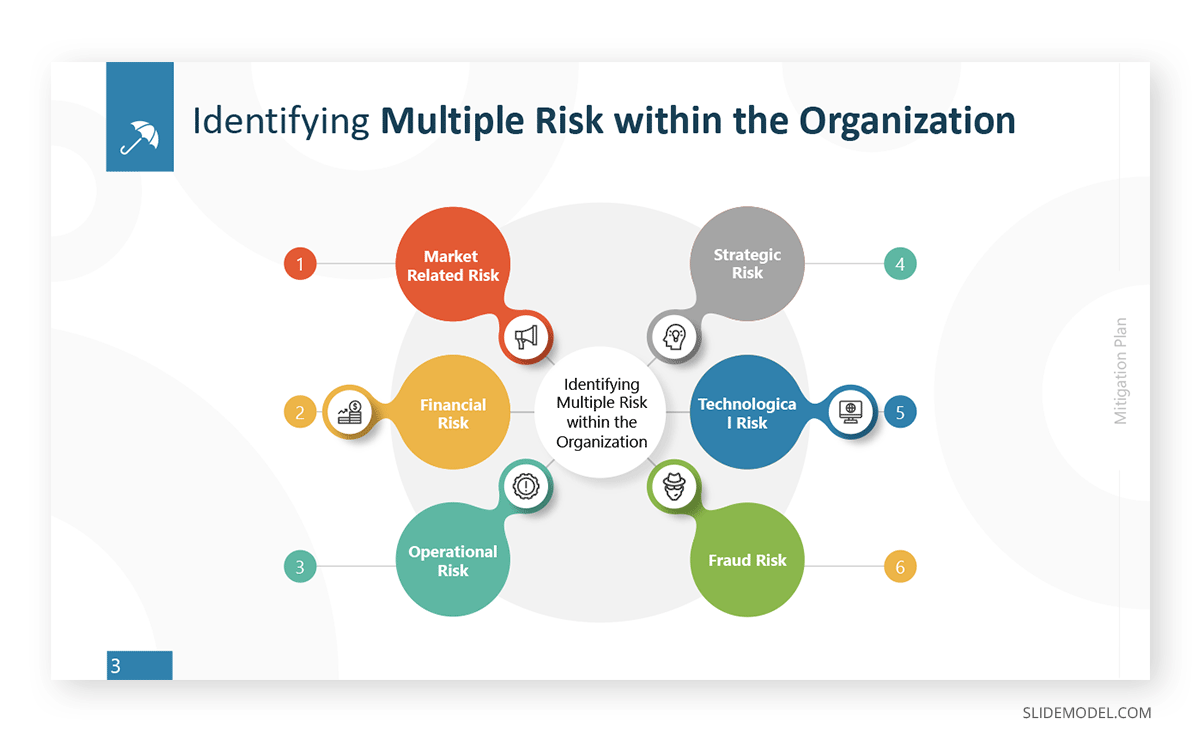

Make sure your professional presentation template points out clearly and simplifies the information that was so carefully extracted. Take into account that all the data to be included in your presentation will be actionable. Use a diagram like the one below to frame the upcoming process of risk management that can follow the in-depth analysis.

Final Words

Analyzing and managing risks is no easy task. One needs to ensure that risk analysis is not done in haste. Many potential hazards need to be considered before you can manage them. If your risk analysis is flawed, you will not be able to mitigate risks and find ways to resolve them. In such a case, the response might be a knee jerk-reaction, resulting in tangible and intangible losses, such as financial or reputational loss, and consequences that might even lead to litigation. On the contrary, risks analyzed and managed correctly can result in gains worth the trouble and even more significant than the potential loss in case of a risk materializing. Alternatively, check our article about risk management techniques.