Securing early-stage funding is rarely about having the perfect financials or a fully polished product. At the seed stage, what convinces investors is your ability to communicate vision, traction, and a credible path forward. That is where the Seed Pitch Deck presentation becomes an invaluable tool.

Whether you are pitching to angel investors, seed funds, accelerators, or early-stage VCs, this presentation needs to strike a balance: it should capture the size of the opportunity, show evidence of validation, and make your ask clear. More importantly, it is your chance to build trust.

This guide explains what a seed pitch deck is, its importance, how it influences investment deals, which slides are essential, and how it differs from a traditional investor pitch deck.

Table of Contents

- What is a Seed Pitch Deck?

- Why a Seed Pitch Deck Matters?

- Seed Pitch Deck vs. Investor Pitch Deck

- How a Seed Pitch Deck Influences Investment Deals

- Elements of a Seed Pitch Deck

- FAQs

- Final Words

What is a Seed Pitch Deck?

A seed pitch deck is a concise presentation, usually delivered in slide format, that showcases your startup’s early vision, traction, and fundraising needs. Unlike later-stage decks that emphasize financial depth, the seed deck focuses on demonstrating why your idea deserves to exist, why now is the right time, and why you are the team to execute it.

The document typically includes:

- Problem definition and urgency

- The solution and unique value proposition

- Early validation (users, pilots, MVP metrics)

- Market opportunity and size

- Business model hypotheses

- Go-to-market strategy

- Team background and capability

- Funding ask and intended use of proceeds

Its primary role is to answer the investor’s fundamental question: Is this an opportunity worth backing at the earliest stage, despite inherent risk? As the presenter, you use this pitch deck to align your story, structure your pitch, and give potential investors a framework to evaluate your idea.

Why a Seed Pitch Deck Matters?

At the seed stage, you rarely have years of financial history, dozens of customers, or a proven distribution engine. What you do have is a story supported by initial traction and a believable roadmap. The seed deck is the tool that makes this narrative coherent and persuasive.

- Investor Decision-Making: Seed investors typically review hundreds of decks per year. A structured presentation allows them to grasp your startup’s core in under 15 minutes. If you fail to capture attention quickly, you will not advance to the next meeting.

- Team and Vision Alignment: Internally, creating this deck forces your founding team to agree on the problem statement, solution, and immediate goals. Misalignment shows through during presentations, and investors notice.

- Strategic Anchor: The deck becomes a single source of truth for your fundraising conversations. When you tweak projections, refine positioning, or adjust go-to-market, it forces strategic clarity.

- Signal of Professionalism: A polished seed deck signals that you respect the investor’s time. Investors don’t just back ideas; they back teams they believe are disciplined, structured, and investor-ready.

Remember that you are not only raising money, you are raising confidence. The seed deck is your most effective medium to make that confidence tangible.

Seed Pitch Deck vs. Investor Pitch Deck

It is easy to confuse the seed pitch deck with a broader investor pitch deck. Both aim to secure funding, but their scope and depth differ.

Seed Pitch Deck

- Focuses on vision, problem-solution fit, and early traction

- Prioritizes storytelling and potential over historical data

- Typically 10-15 slides, designed for clarity and speed

- Appeals to investors who specialize in early-stage risk

Investor Pitch Deck

- Contains detailed financials, cohort analyses, and unit economics

- Requires customer acquisition cost (CAC), lifetime value (LTV), churn, etc.

- Often longer and data-heavy, aimed at VCs managing larger funds

- Assumes product-market fit is proven, focusing on scalability

In general, the seed pitch deck isn’t required to provide financial depth, whereas it is a gigantic red flag if an investor pitch doesn’t include that information. When you’re at seed stage, presenting an “investor-style” (later-round) deck full of missing metrics makes you look unprepared.

How a Seed Pitch Deck Influences Investment Deals

In early fundraising rounds, investors know the risk is high. They are not only investing in your product: they are investing in you, your team, and your ability to execute.

- Investor Perception: A clear, data-backed presentation signals competence. A messy or vague one raises doubts.

- Valuation Discussions: The quality of your deck indirectly affects how much leverage you have in negotiating valuation and terms. The stronger your case, the less you will have to concede.

- Deal Velocity: Well-structured decks move deals forward faster. They reduce back-and-forth questions and help investors bring your case to their partners or committees with minimal friction.

- Investor-Startup Fit: Not all money is equal. By presenting your story effectively, you attract the right kind of investors; those aligned with your vision and stage.

Think of the deck as your investment catalyst. It won’t close the deal by itself, but it accelerates investor interest, sharpens conversations, and gets you closer to a term sheet.

Elements of a Seed Pitch Deck

Title Slide

The title slide is the handshake of your pitch. It’s often underestimated, but it sets the tone for everything that follows. Think of it as the visual cue that signals professionalism, brand identity, and clarity. On this slide, you include your startup’s name, logo, tagline, and presenter details. Some founders also add the date or a discreet version number for tracking when pitching to multiple investors.

Why is it important? Investors often receive dozens of decks in one week. They skim through files on email threads or shared drives. A well-designed, minimal, and brand-consistent cover makes your presentation recognizable at first glance. It reduces confusion and reinforces that your startup is organized and detail-oriented.

Think of this as not oversell but to introduce. Avoid clutter, marketing slogans, or long mission statements. Instead, rely on a clean design, cohesive colors, and typography aligned with your brand. If you are pre-product and still evolving your visual identity, at least make sure the cover looks intentional: use consistent fonts and align elements neatly.

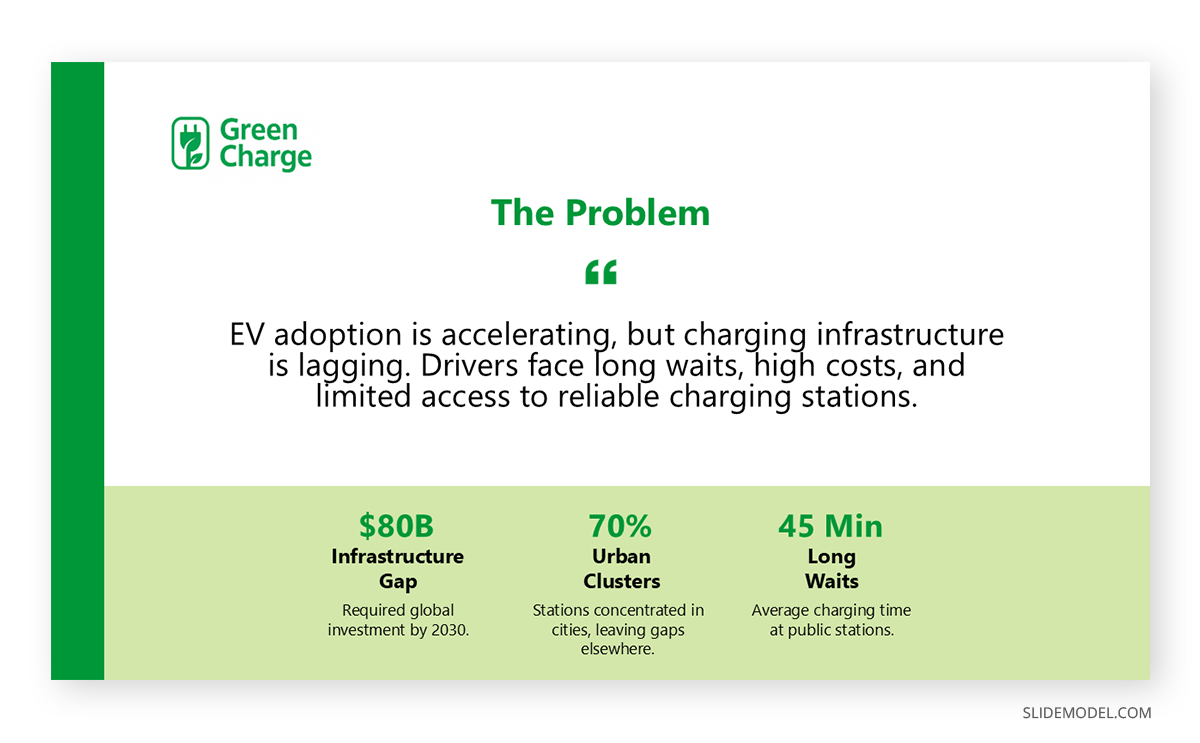

Problem Slide

The problem slide is the foundation of your narrative. It answers the question: Why does this startup deserve to exist? Without a clear, urgent, and relatable problem, the rest of the deck collapses. Investors don’t back solutions in search of problems: they back founders who have identified meaningful gaps in the market.

As the presenter, your job here is to quantify pain. That means moving beyond vague statements like “users are frustrated.” Show data points, user quotes, or market inefficiencies. Example: “80% of small businesses still rely on manual spreadsheets for payroll, leading to an average of 12 hours lost per month.” This transforms a general issue into a measurable inefficiency worth solving.

The problem slide also benefits from storytelling. Present a scenario investors can picture: “Imagine a logistics manager losing $50,000 annually due to outdated routing software.” These tangible examples resonate more than abstract figures.

Why it matters: if the problem doesn’t feel urgent or painful, your solution won’t seem necessary. A common mistake is exaggerating the issue. Don’t claim it’s a trillion-dollar pain unless you can back it up. Investors prefer smaller but real problems with credible growth potential over inflated figures.

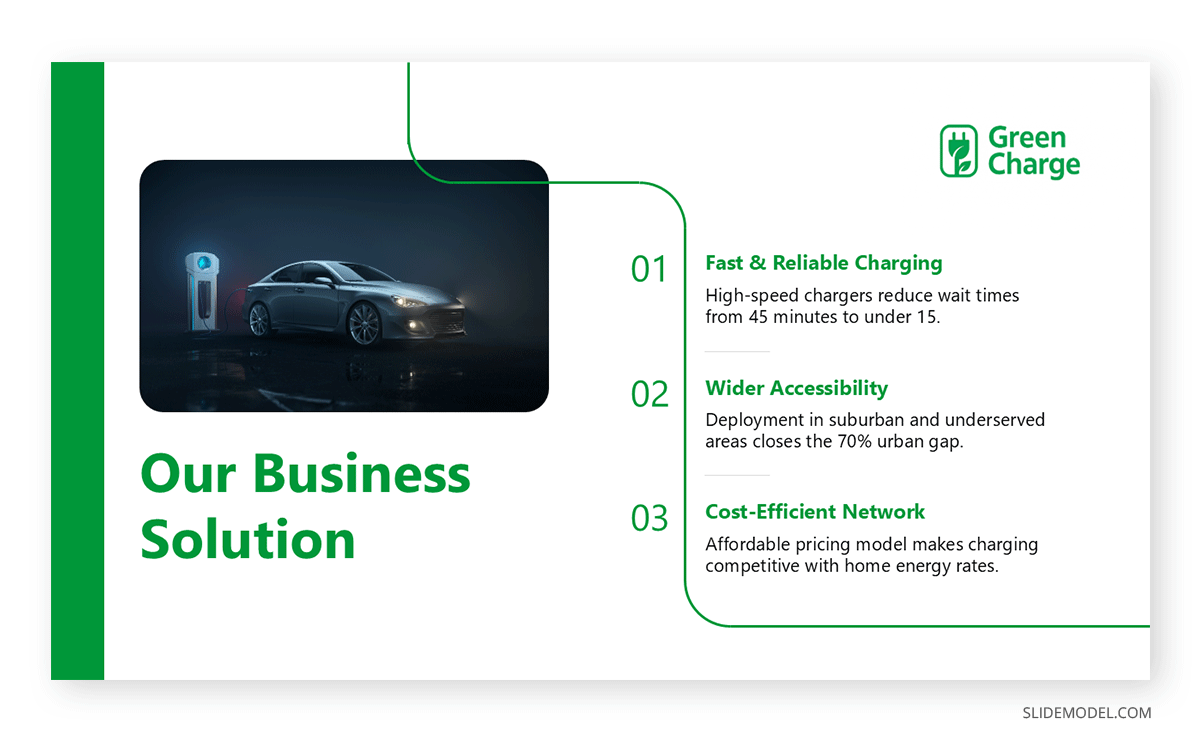

Solution Slide

The solution slide transitions from “what’s broken” to “how we fix it.” This is where you introduce your product, service, or platform. Investors want to see not only what you’ve built (or plan to build) but also why it’s uniquely positioned to solve the problem.

Visuals are your best ally. Don’t rely on your speech, let infographics, graphs or charts, or any kind of visual communication element tell the story. Include product screenshots, mockups, or prototypes. If you have an MVP, highlight its core functionality. If your solution is still in development, show diagrams or workflows that clearly communicate the concept. Avoid jargon-heavy explanations that confuse rather than clarify.

A strong solution slide demonstrates differentiation. Ask yourself: how is your approach better, faster, or more scalable than alternatives? For example: “Unlike manual payroll spreadsheets or costly enterprise systems, our SaaS platform automates compliance for SMEs at 10% of the cost.” This clear comparison shows efficiency and affordability.

Why it matters: Investors are trained to spot “solution in search of a problem” traps. By linking your solution tightly to the previously defined pain point, you show coherence. The goal is to make the audience think, of course this should exist.

Common mistakes to avoid: endless feature lists, overcomplicated diagrams, or presenting tech as the solution itself. Investors fund value delivered, not technology for its own sake. Keep the message simple: what your product does, how it works at a high level, and why it solves the defined pain point better than alternatives.

Market Opportunity Slide

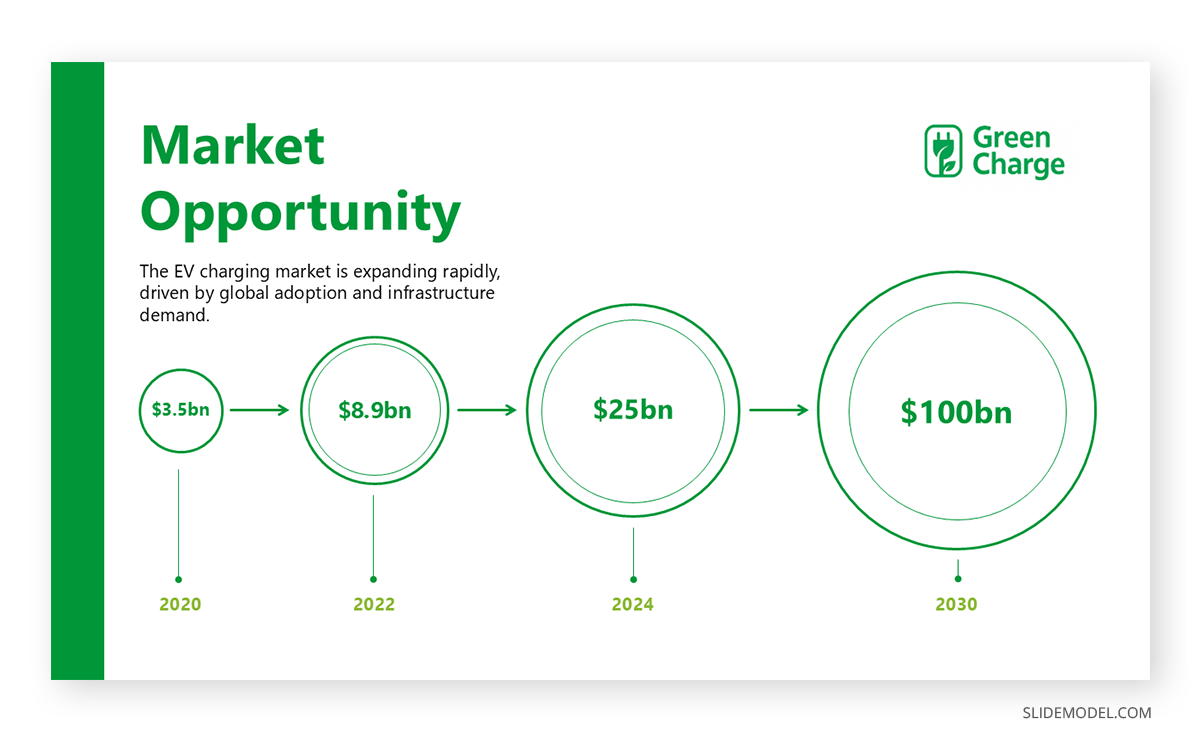

The market opportunity slide answers one of the most critical investor questions: How big can this get? Even the best product fails to attract funding if the addressable market is too small. This section is where you frame the size, urgency, and growth potential of your target market.

Start by breaking down TAM (Total Addressable Market), SAM (Serviceable Available Market), and SOM (Serviceable Obtainable Market). For example, if you’re building a SaaS payroll system, TAM may be the global HR software market, SAM might be small-to-medium businesses in North America, and SOM is the segment you realistically plan to capture in the next 3-5 years. This layered approach shows ambition balanced with realism.

Recommended lecture: TAM, SAM and SOM in Presentations

Contextualize your market numbers. Show growth trends, regulatory changes, or consumer behavior shifts that amplify opportunity. Example: “The $10B SME payroll software market is projected to grow at 14% CAGR due to regulatory digitization.” This ties your solution to undeniable external forces.

Business Model Slide

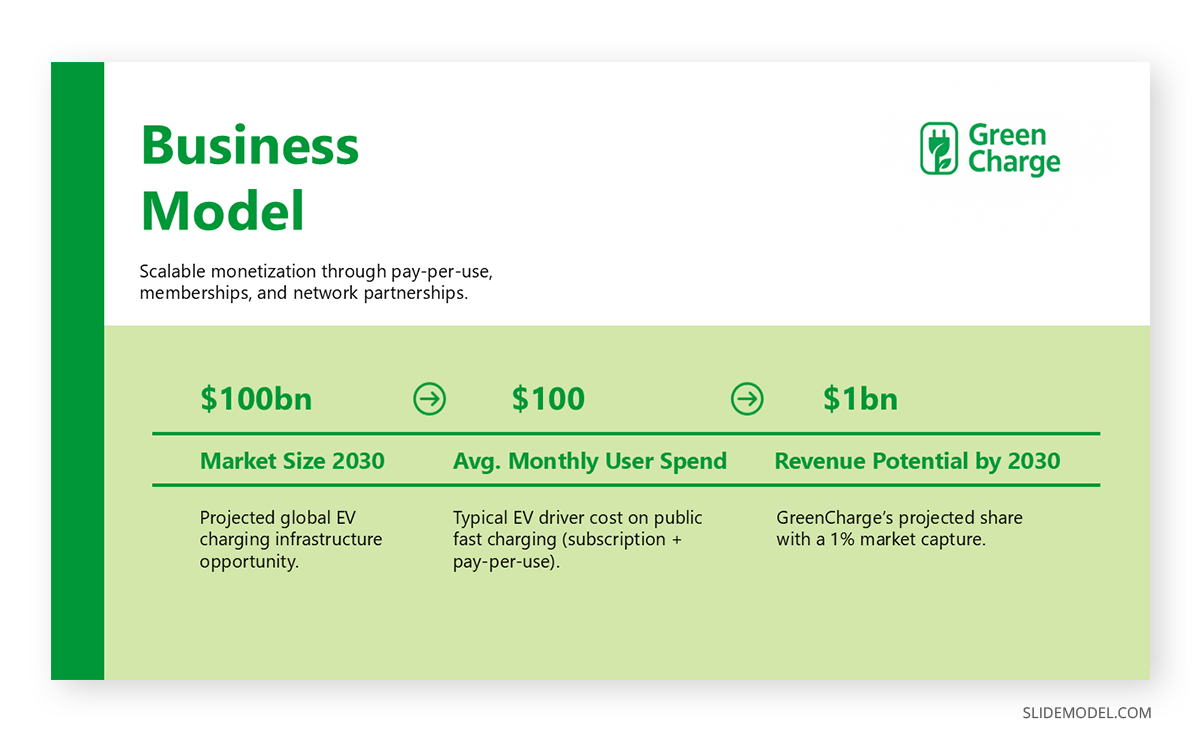

The business model slide answers the investor’s central question: How will this startup make money? At the seed stage, you may not have precise financial data, but you need to demonstrate a clear hypothesis about revenue streams and monetization strategy.

You must outline how your solution translates into financial sustainability. Will you operate as a subscription SaaS model, charge transaction fees, sell licenses, or build a marketplace? Be explicit. Example: “We plan to charge $49/month per SME account, with add-on modules for compliance and payroll.” The goal isn’t to prove the model down to the cent but to show that you’ve thought deeply about how value becomes revenue.

Investors also want to understand pricing rationale. How did you arrive at your price point? Is it benchmarked against competitors, validated by pilot customers, or derived from cost-plus logic? Supporting evidence here makes your model believable.

Another key element is scalability. A solid business model demonstrates potential for growth without linear cost increases. For instance, SaaS products scale more efficiently than consulting services. Highlight why your model offers attractive margins as you expand.

Recommended lecture: SaaS Presentation

Avoid the trap of presenting multiple disconnected models (“ads, subscriptions, licensing, and affiliate revenue”) just to look big. At seed stage, clarity beats complexity. Show your core model and explain optional expansions later.

Finally, link the business model back to the market opportunity. If your SOM is worth $500M, show how your pricing and distribution strategy could realistically capture part of it. Frame this section as your bridge from vision to economics.

Traction or Validation

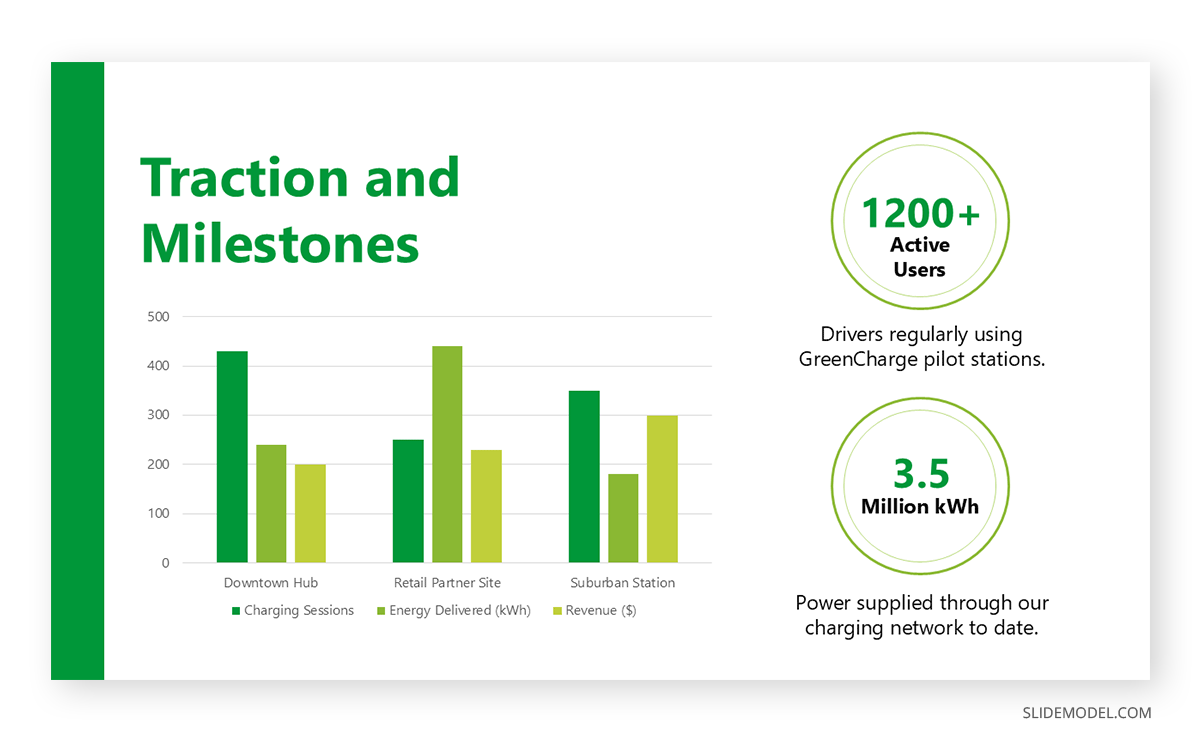

At seed stage, investors know you won’t have thousands of customers or millions in revenue yet. What they do expect is evidence that the market wants what you’re building. That’s the role of the traction slide.

The core aspect of this stage is to prove credibility through numbers, signals, and external validation. Examples include:

- Early user sign-ups or pre-orders

- MVP pilot results

- Partnership agreements or letters of intent

- Testimonials from beta users

- Growth trends in waitlists or engagement metrics

Even small numbers matter if presented with context. For example: “100 SMEs signed up for our beta in the first month without paid marketing.” This signals organic demand. Similarly, “Our MVP reduced payroll processing time by 40% in a pilot with three companies” shows concrete outcomes.

This approach proves to investors that your solution isn’t just theoretical. Validation reduces perceived risk. If others outside your team already show interest or derive value, that’s a strong signal.

Avoid vague claims like “users love it.” Quantify results wherever possible. Screenshots of testimonials, photos of pilots, or logos of pilot partners can also add credibility.

Go-to-Market (GTM) Strategy

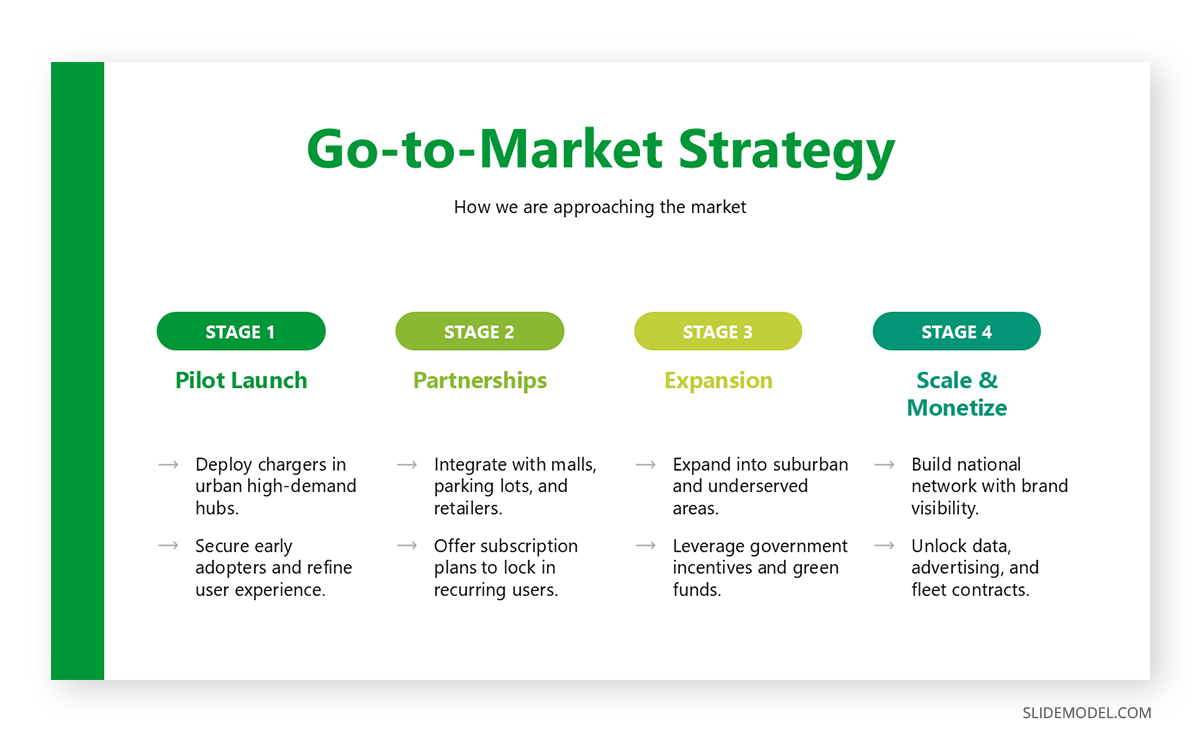

A brilliant product without distribution is worthless. The go-to-market strategy slide demonstrates that you know how to reach, acquire, and retain customers in a repeatable way. Investors want to see not only that demand exists, but that you have a plan to capture it.

Explain your channels clearly. Are you pursuing direct sales, inbound marketing, partnerships, app stores, or distribution through existing platforms? Example: “We will target SMEs through LinkedIn ads, local accounting firms as channel partners, and integrations with QuickBooks.” This shows you’ve thought about both direct and indirect growth paths.

Break down your plan into phases:

- Early adopters: How will you acquire your first 100 users?

- Scaling: What channels unlock growth at 1,000 or 10,000 users?

- Retention: How will you keep customers engaged and minimize churn?

Numbers are persuasive here. Show expected CAC (customer acquisition cost), LTV (lifetime value), and payback period if you’ve calculated them. Even directional estimates reassure investors you understand the economics of growth.

Visuals such as funnel diagrams or phased timelines help clarify execution. Tie back to your market slide: prove that your GTM strategy is aligned with the target audience you identified.

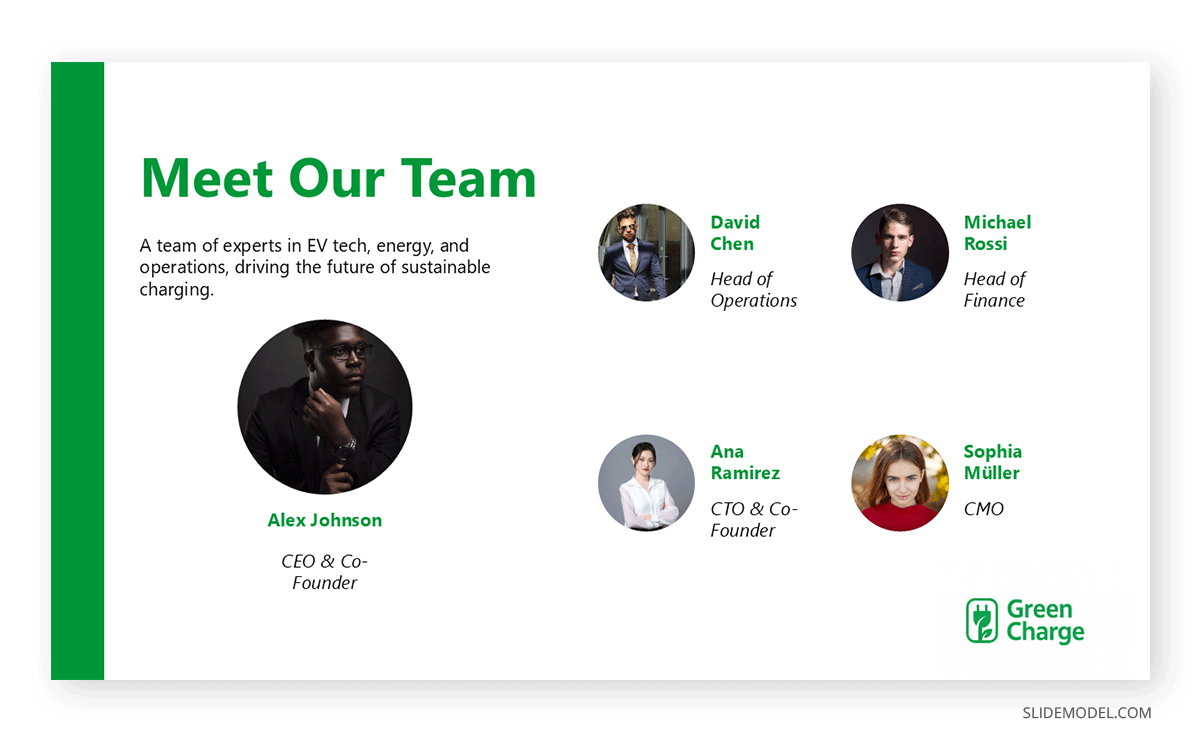

Introducing the Team

At seed stage, investors back people more than numbers. The team slide is where you demonstrate that you and your co-founders are the right people to solve the problem and build the company.

Highlight relevant experience without turning this slide into a CV dump. And visuals are also important as you cannot rely solely on smartphone photos; use professional images as if you were curating your LinkedIn profile.

Focus on the unique blend of skills, domain expertise, and commitment that gives your team a competitive edge. Example: “Our CTO previously scaled payroll SaaS infrastructure at [Company], while our CEO spent 7 years consulting SMEs on compliance.” This shows both technical and market credibility.

Complement expertise with proof of resilience. Investors know startups face pivots and crises. Teams that have shown grit, complementary skill sets, and coachability are more attractive. You may also include advisors, especially if they add domain credibility or investor trust. But avoid padding the slide with names that don’t contribute actively.

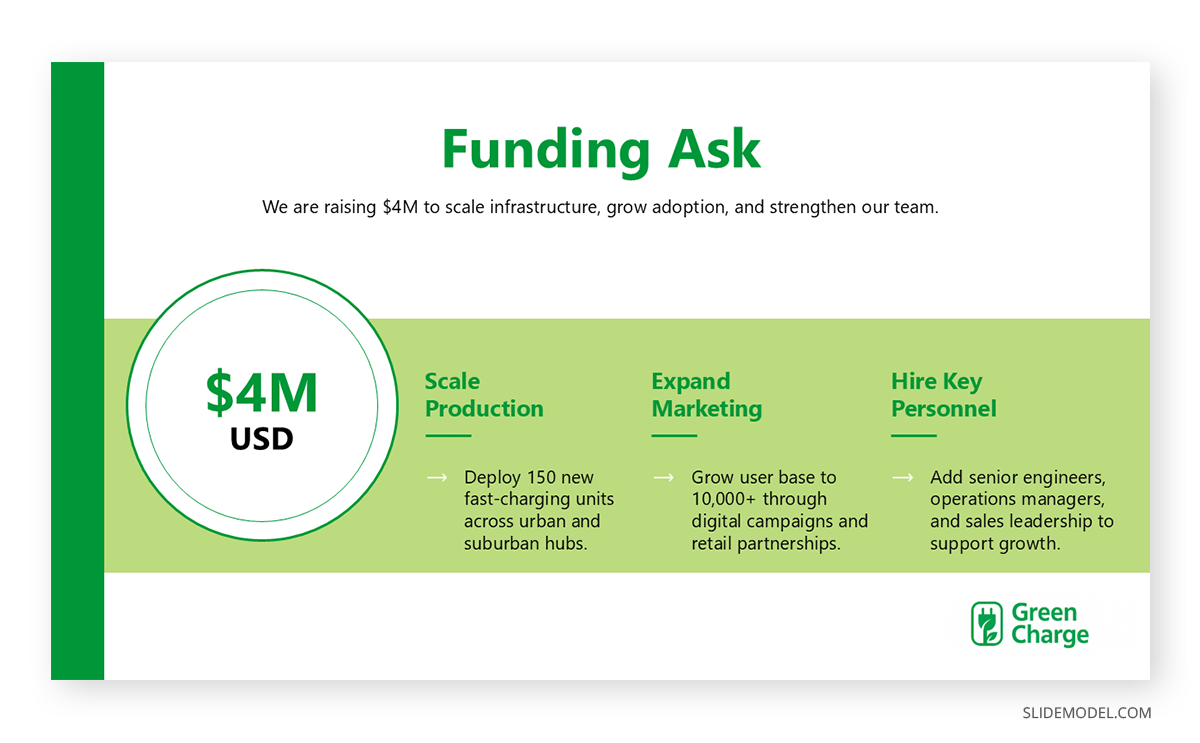

Financials and Ask Slide

The financials and ask slide closes your narrative. Here, you tell investors how much capital you are raising, how it will be used, and what financial trajectory you expect.

Given your business is at its initial stage, financial projections are inherently uncertain. At this stage, financial projections should be treated as directional. Investors understand that precision is impossible this early, but they expect a clear picture of how funding will extend runway, drive product development, and accelerate traction. The emphasis should be on ambition grounded in realism, supported by high-level forecasts and disciplined allocation of funds.

The “ask” must be clear. Example: “We are raising $1.2M to extend runway for 18 months, focused on product development, customer acquisition, and team expansion.” Break down how the funds will be allocated (e.g., 50% product, 30% sales/marketing, 20% operations). This shows discipline in capital planning.

Remember, ambiguity here signals lack of clarity. If investors don’t understand how much you’re raising and why, they lose confidence. Ending with a crisp, specific ask transforms your deck from storytelling into a tangible funding opportunity.

FAQs

How long should a seed pitch deck be?

Aim for 10-15 core slides. You can have appendices with deeper data, but your main story must fit within 20 minutes.

Do I need financial projections at the seed stage?

Yes, but keep them directional. Show 3-5 year forecasts with explicit assumptions, not granular precision. Investors know early numbers are estimates.

Should I include competitor slides?

Absolutely. Even at the seed stage, investors want to see that you understand the competitive landscape and your differentiation.

Should I include a competitor pricing comparison?

Yes, but keep it simple. A clear chart or matrix comparing your pricing to competitors highlights your positioning and defends your business model without overwhelming the deck.

Can I reuse my deck across all investors?

Not exactly. Keep a core deck, but adapt the emphasis depending on whether you pitch angels, seed funds, or accelerators.

Do investors expect a product demo?

If possible, yes. Even a lightweight MVP demo presentation increases credibility. If you can’t, visuals and mockups are the minimum.

Should I add disclaimers or confidentiality notices?

Yes, especially if you’re sharing with multiple investors. A small “Confidential” tag on slides is enough. Full NDAs are uncommon at seed stage.

Should I customize the seed pitch deck for each investor?

Yes. The core deck stays the same, but you should tailor the emphasis. For angels, highlight vision and passion. For institutional seed funds, emphasize market size and traction.

Do I need to include an exit strategy at the seed stage?

Not necessarily. Some investors prefer to see potential exit paths (such as acquisition or IPO), but the priority at the seed stage is proving the problem-solution fit and growth potential.

How important are visuals in a seed deck?

Very important. Investors scan quickly. Clean charts, product screenshots, and simple infographics communicate faster than text-heavy slides.

What happens if I don’t hit the milestones after funding?

Investors expect pivots. The key is to show you’ve chosen realistic, measurable milestones. If you miss, transparency and corrective action matter more than perfection.

How many team members should I feature?

Focus on founders and key early hires critical to execution. Beyond 4-5 profiles, it becomes cluttered. Advisors can be added separately.

Do I need a slide about intellectual property (IP)?

If patents, trademarks, or proprietary tech exist, include them. If not, address defensibility through speed, expertise, or market entry advantage.

Should I include a timeline or roadmap?

Yes. A 12-18 month roadmap reassures investors you have a plan for capital deployment and milestones before the next round.

How much financial detail is too much?

Avoid line-item budgets. Stick to top-level forecasts and how funds will be allocated. Leave detailed financials for due diligence.

How do I handle sensitive financial assumptions?

Include directional forecasts in the deck but reserve detailed spreadsheets for follow-up discussions. This way you remain transparent without overexposing assumptions.

What if I don’t have revenue yet?

That’s fine at the seed stage. Replace revenue slides with strong validation: pilots, LOIs, user engagement, or waitlists.

Do I need a “use of funds” breakdown?

Yes. Even at the seed, clarity on where money goes is critical. Investors expect to see high percentages on product and growth, not overhead.

Should I circulate the seed pitch deck before meetings?

Most investors prefer a teaser or “light deck” first. The whole deck can be presented live to maintain context and narrative control.

What about including social or environmental impact?

If it strengthens your value proposition, yes. For ESG or impact-focused funds, this can become a differentiator. Otherwise, mention briefly if relevant but don’t overemphasize.

Final Words

A seed pitch deck presentation is more than a fundraising tool. It is the first strategic document that consolidates vision, opportunity, and execution into a single, clear narrative. At this early stage, numbers will always be limited, but clarity of purpose, evidence of demand, and a structured plan make the difference between sparking investor interest or losing it.

The value of building this type of deck goes beyond securing capital. It forces the founding team to align around the problem being solved, the strategy for reaching the market, and the milestones that define progress. Investors recognize when this groundwork has been done and when it hasn’t. A well-prepared deck signals discipline, foresight, and readiness to take responsibility for growth. When done correctly, it becomes both a fundraising instrument and a decision-making compass for the company’s next steps.