Preparing financial statements it may not sound like the most exciting task. Albeit, it’s a hugely important one, especially if your company is seeking investment or planning to expand its operations. Not to mention that most businesses are obliged to present a statement of retained earnings to the Tax authorities.

In this post, we’ll show you how to prepare a statement of retained earnings, plus share a couple of presentation design tips for turning that document into an engaging slide deck. But first, let’s make sure that we are on the same page term-wise and have some definitions outlined.

What is Retained Earnings ?

In accounting, retained earnings (RE) is the amount of money (net income) left for the business after dividends where paid. This amount is generally used for investments or future dividends.

Shareholders and management always take a look at retained earnings on balance sheet. It is located in the liabilities section. It is an important indicator of company debt, and has direct relationship on executive decisions. It is earned money the management will use (with some purpose), and not returned to the investors.

What is a Statement of Earnings?

A statement of earnings (also known as profit & loss statement or P&L Statement) is a detailed summary of the company’s revenues and expenses, generated over the reporting period such as a fiscal year or quarter. This financial statement proves the organization’s ability (or lack of thereof) to generate revenue, reduce costs or do both. It includes information on all the profit the company has secured.

What is a Statement of Retained Earnings ?

A statement of retained earnings, on the other hand, is a business document that reconciles the beginning and ending retained earnings for a certain period (e.g. month, quarter, year).

The statement is designed to highlight how much a company took in from sales, the cost of goods/services sold and other expenses. In short, retained earnings represent the profit/income the business has generated but did not pay out as dividends. That money remains in the company’s accounts for the next year.

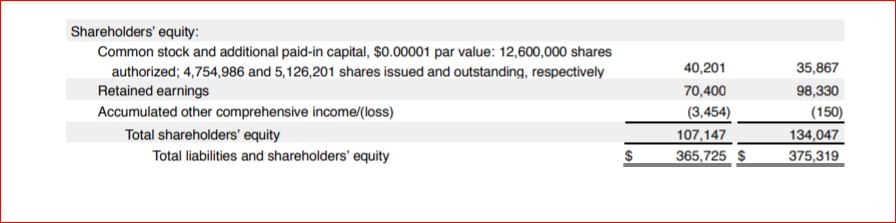

Below is a statement of retained earnings example from Apple:

Retained Earnings vs Net Income: The Difference

Both terms are closely related, yet carry a somewhat different meaning. Income statements are more inclusive. Net income is calculated by subtracting all the operating expenses (e.g. payroll, rent, overhead costs etc) from the total revenue.

When a certain amount of net income is not paid out to shareholders or reinvested back into the business, it becomes retained earnings. Mind that some companies choose to keep money in retained earnings accounts for years, so the total figure you see on some statements is a result of many years of hard work savings.

4 Good Reasons to Prepare a Retained Earnings Statement

The immediate benefit of creating a detailed retained earning statement is that your company (or other entities) can see how much net income you are turning in and what you can set aside into those “savings”.

As well, there are a few more valid reasons for creating a retained earnings statement:

- It’s an excellent tool for assessing your business growth and its financial health over time.

- Retained earnings statements are an excellent starting point for tax season preparations. However, you will still need to gather additional data from your income statement accounts.

- If you plan to apply for a loan, expand your business or secure new venture capital, retained earnings statements will show the creditors how well your business saves money for the future.

- Finally, these statements majorly help with financial decision making. For instance, you can clearly see whether you can afford to carry over some income for the future (cumulative retained earnings) or take out some money and re-invest it in new equipment.

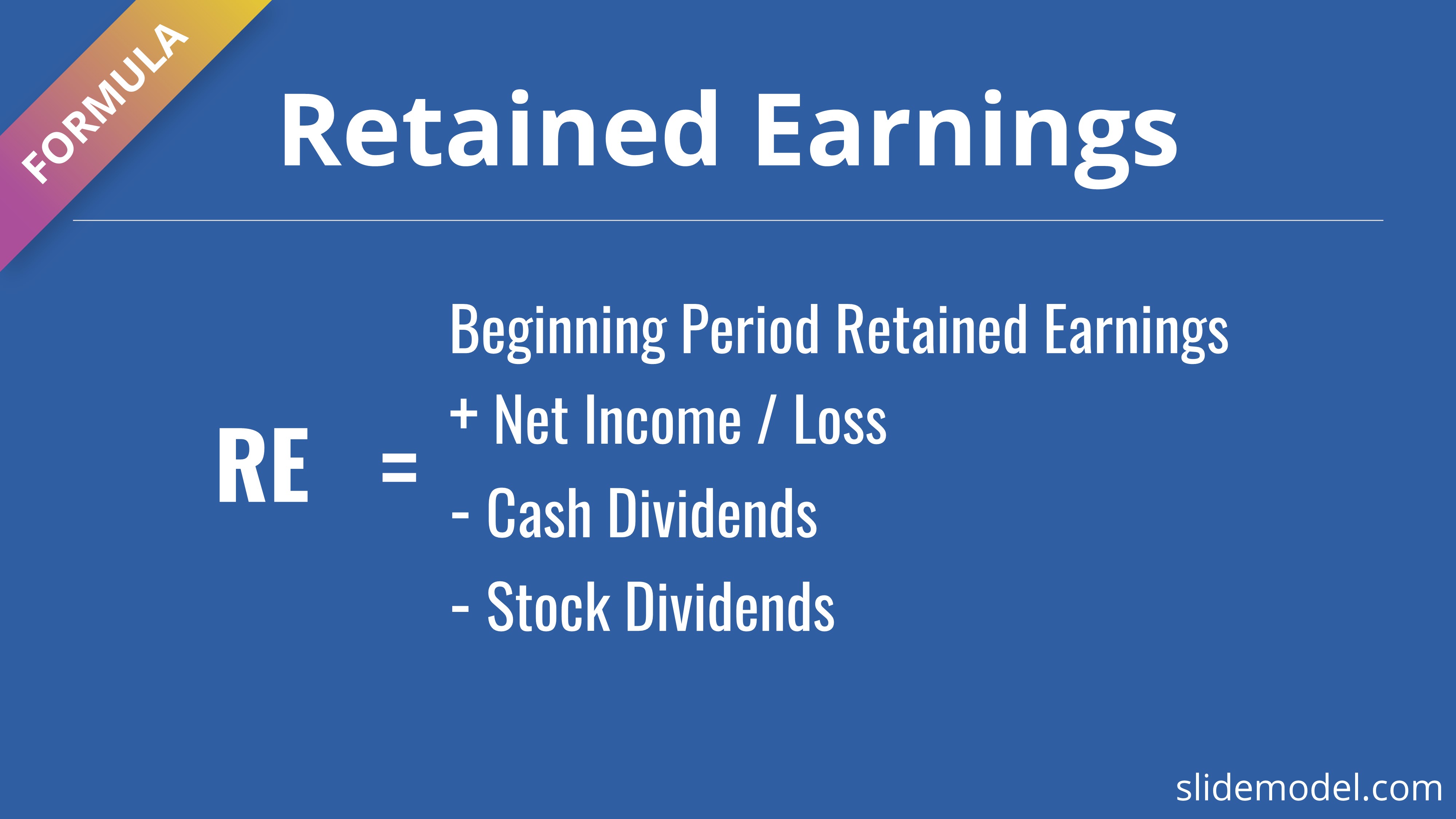

A Quick Formula for Retained Earnings

You might be asking how to calculate retained earnings ? Calculating retained earnings is relatively simple. All you need to do is apply the following retained earnings formula:

This accounting formula is suitable for in-house retained earnings calculations. If you are an investor, below are some additional tips on how to calculate retained earnings in stockholder equity with common stock.

First, you will need to locate the company’s retained earnings on the balance sheet. Typically, those can be found on the stockholder equity side. If those are not recorded, you can do the calculation yourself from other figures.

Step 1: Find information about the total amount of assets and liabilities of the company. Subtract liabilities from assets to calculate stockholder equity.

Step 2: Locate the common stock line item on the balance sheet. If you know that the only two items in stockholder equity are common stock plus retained earnings, then subtract the common stock line item figure from the total stockholder equity. The difference is the company’s retained earnings.

How to Prepare a Statement of Retained Earnings: Step-by-Step Guide

A statement of retained earnings can be prepared as a standalone document or a presentation. However, many businesses choose to add it at the bottom of another financial statement e.g. the balance sheet or a merged statement of income and retained earnings. You can also choose to submit it as part of your business plan during loan/funding application.

Recommended template for presentations: Effective Business Plan PowerPoint Template.

Here’s a quick summary of what goes on a retained earnings statement:

- Beginning retained earnings

- Net income

- Cash and stock dividends

The statement of retained earnings format is pretty standard. You’ll have to first include a three-line header with the following information:

- First line: the name of your company

- Second line: “Statement of Retained Earnings”

- Third line: add the accounting period e.g. “For the Year Ended 2017”. You can also choose a month or a quarter instead

Further, a statement of retained earnings template will include the following figures that you’ll need to calculate and present as the grand total.

1. State The Beginning Balance of Retained Earnings From The Prior Reporting Period

The first item appearing on the statement of retained earnings is the beginning balance of retained earnings you are carrying over from the previous reporting period. If you are creating this statement for the first time, your number will be zero.

Otherwise, the first line of the statement of retained earnings for a sample company will look like this:

Retained Earnings, May, 31, 2016 – $50,000

2. Calculate and Add Net Income From The Prior Reporting Period

In most cases, the accounting statement of retained earnings is prepared after the income statement. So when you are creating one, you’ll probably have the income numbers at hand. If not, reach out to an accountant for some help.

Back to the example: our sample company has generated a net income of $150,000 in the second quarter. So the retained earnings statement will now include the following information:

Retained Earnings, May, 31, 2016 – $50,000

Net Income, 2nd Quarter – $150,000

Total $200,000

However, a company may not generate profit during every single reporting period. If there’s a loss recorded on the income statement, it should be subtracted from the beginning retained earnings. In this case, the statement for an example company will feature negative retained earnings:

Retained Earnings, May, 31 2016 – $50,000

Net Income, 2nd Quarter – Loss of $75,000

Total ($25,000)

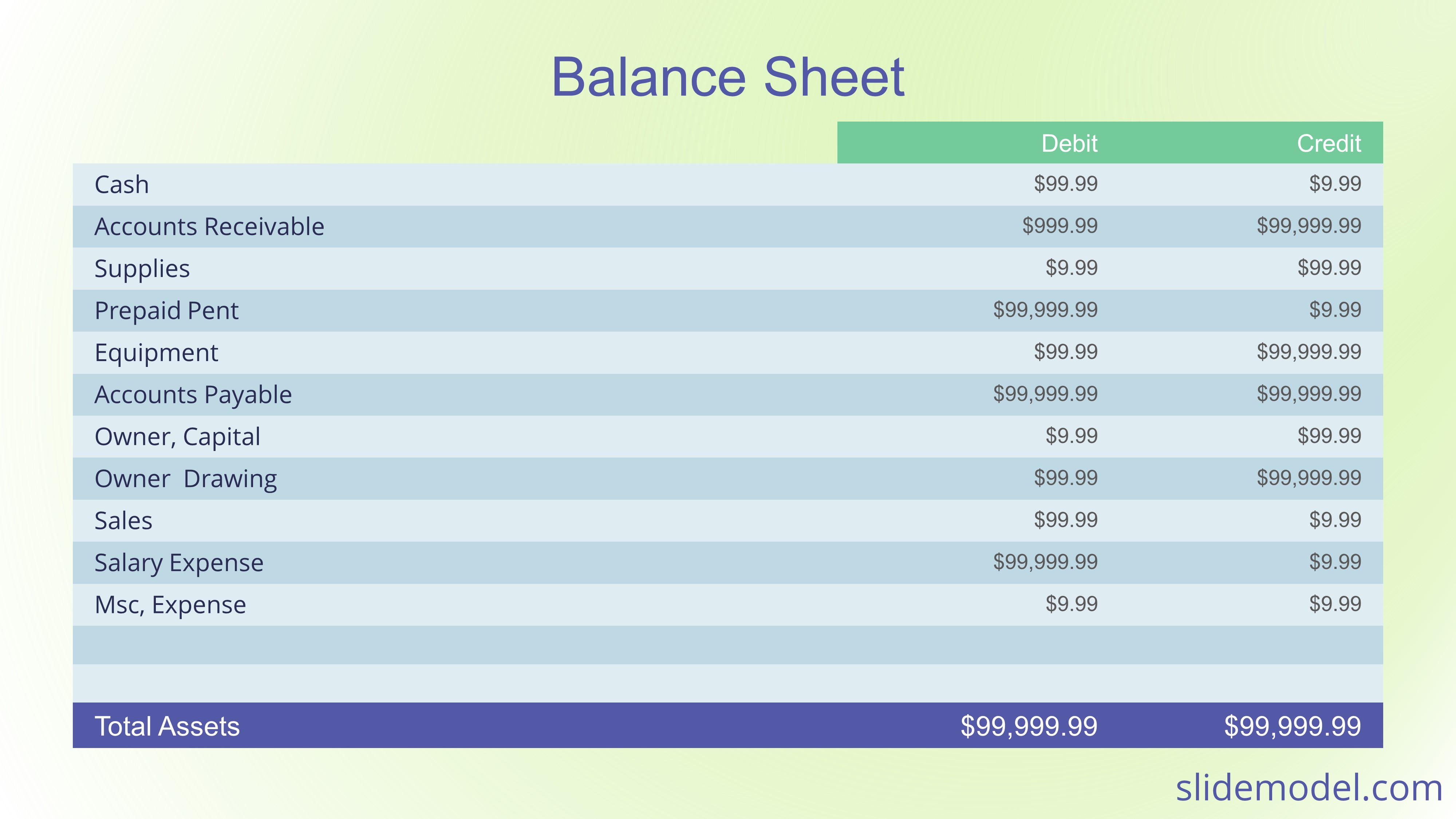

Apart from loss, negative retained earnings can result from non-optimal dividend distribution within a certain period of time. For example, the total amount of business net income + beginning retained earnings (if any) can be lesser than the distributed dividends on the balance sheet.

Here’s how to record negative retained earnings:

- The figure is added to the debit balance in the retained earnings account, rather than the credit balance.

- This should be a separate line item on the balance sheet that can be also called an “Accumulated Deficit”.

3. Subtract Cash and Stock Dividends That Are Paid Out to Investors

The next step is to record the dollar figure of dividends paid out of the company’s net income. Depending on your business type, this figure can be zero (if no dividends are paid). Here’s a sample calculation to illustrate this:

Retained Earnings, May 31, 2016 – $50,000

Net Income, 2nd Quarter – $150,000

Total $200,000

Dividends ($75,000)

Whether you are paying dividends in cash or in stock, both of them must be recorded as a deduction. For instance, if your board of directors declares a dividend of $3.00/share on 10,000 shares of stock, then $30,000 must be subtracted from the retained earnings statement (even if the dollar equivalent has not yet been paid).

4. List the Final Total of Retained Earnings

Now let’s calculate the ending retained earnings. This will be the final figure with the dividends taken out. Here’s an example of what will go onto your balance sheet:

Retained Earnings, May 31, 2016 – $50,000

Net Income, 2nd Quarter – $150,000

Total $200,000

Dividends ($75,000)

Retained Earnings, August 31. 2016 – $125,000

There you have it — the complete statement of retained earnings that can be shared with investors or other organizations.

What Retained Earnings Tells You?

Looking at a RE statements itself is just an incomplete analysis, but the reader can spot insights about the behavior of the organization in terms of capital left aside for the future.

Shareholders expect dividends for their investment, but there are also taxing practices (depending on where the organization is incorporated) that provides benefits for not paying dividends and leaving the money aside. Another reason for leaving money is for future investments or as a collateral for requesting future loans.

Some investors may argue that leaving too much money aside, consistently, is a signal of a executive managements that does not know how to invest money for increasing organizations value.

If period after period RE are reinvested in the business in order to grow, the RE statement will show a table or slowing increasing number over periods.

How to Present a Statement of Retained Earnings to an Audience

You were asked to prepare that statement of retained earnings for a reason. Perhaps you are pitching your startup to investors or want to secure a business loan from a traditional financial institution. In either case, you may be asked to walk someone through the state of your financial affairs.

So instead of just submitting those sample calculations, along with a bunch of balance sheets, shape them up into a detailed and engaging financial presentation. Here are some tips just for that.

1. Present Your Retained Earnings Statement as Part of Your Business Plan

There are several things investors absolutely want to see in the financial section of a business plan:

- Sales volumes

- Profit margins

- Customer Acquisition Costs

- Overall cash flow (including all the data on your balance sheet + retained earnings)

- Debt

- Accounts Receivable Turnover

- Current dividends

Most investors would be eager to know these key metrics as they give a rather accurate glance into your company’s financial health, future profitability and the kind of ROI an investor may expect to get.

Make sure to present the use you will give to retained earnings within your plan.

Use an Effective Business Plan PowerPoint Template to present this data:

2. Don’t Make Anyone Do The Maths For You

When presenting financial statements and related information, a lot of people merely pile up the data at hand and put it on display without any additional insights and commentary. So the audience needs to “do the math” themselves to figure out the numbers they want to know. And this will not be playing in your favor as most investors are then left with no context and no easy way to benchmark or understand the financial story you are trying to tell.

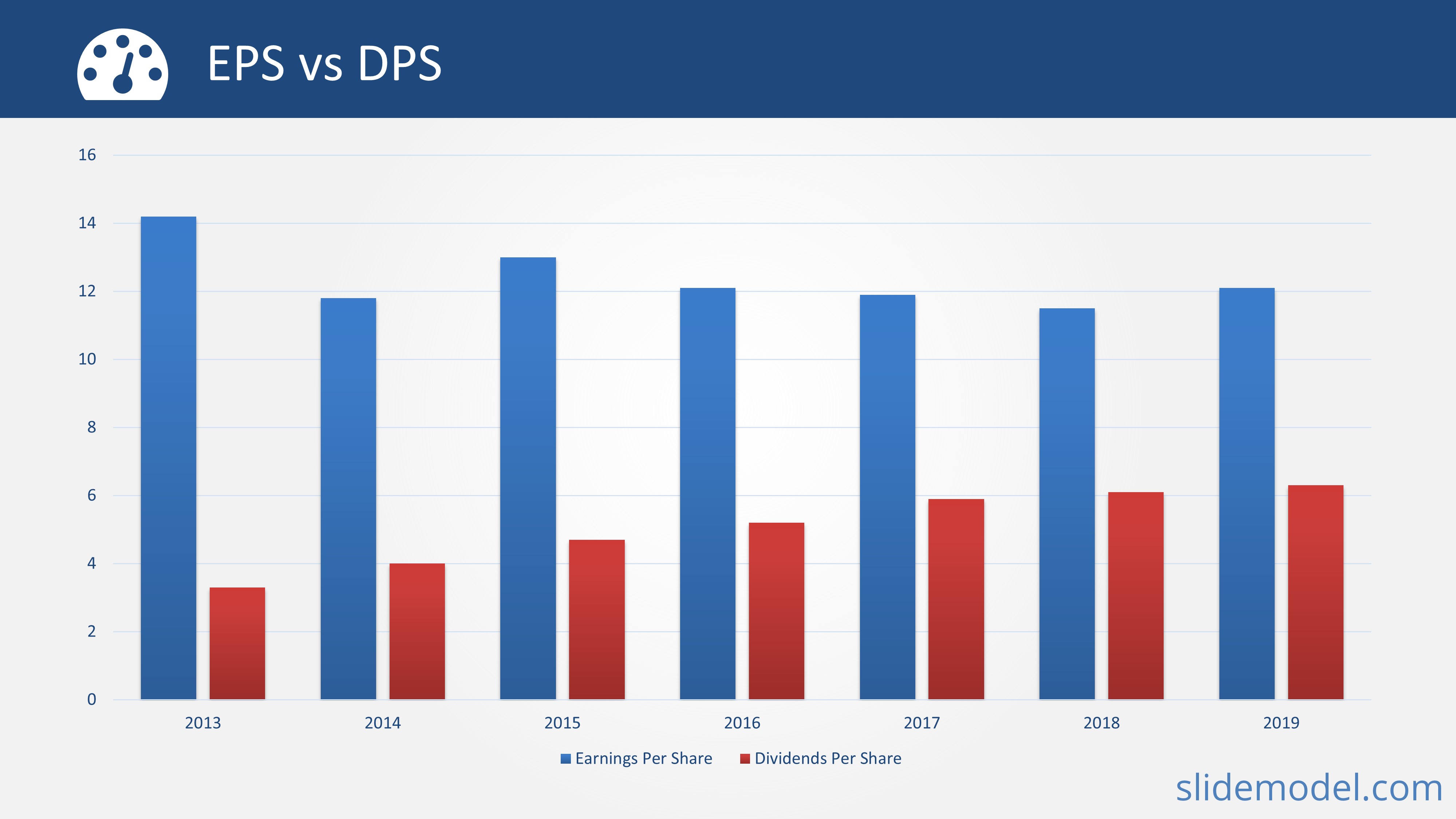

Hence, it’s always worth summarizing your key numbers and translating them into easy-to-grasp insights. For example, you can use a Financial Statements PowerPoint template to show how your declared dividends per stock have changed YOY and then summarize how much your company typically pays out per year, plus what you retain in your accounts.

How to find retained earnings? As mentioned before, the RE of the period being discussed can be found in the Balance Sheet, or in its own retained earnings statement.

3. Don’t Forget to Highlight The Return on Retained Earnings (RORE)

Return on retained earnings (RORE) is another useful calculation worth adding to your presentation, as it shows how well the company’s profits, after dividend payments, are reinvested. RORE is a strong indicator of business growth potential.

As well, it’s a good representation of how much the company’s retained earnings have contributed to an increase in the stock’s market price over time. Clearly, stocks with steady growth will yield more earnings over time with the money they have held back from shareholders.

Conclusions

Creating a statement of retained earnings can leave you deep in accounting software for a few hours. But it’s a handy document, worth preparing regularly to assess your financial health, speed up tax preparation and develop more persuasive pitches to investors.

And if you need help with preparing a great presentation, check out premade business PowerPoint templates that come equipped with loads of financial slides.