Businesses can be affected due to consumer behavior that they might find hard to predict. Many theories, models and research have long tried to predict motivations of consumers for buying goods or services based on consumer preferences. In order to classify different types of consumers into market segments. Perhaps the most underrated concept in this regard has been the endowment effect and its implications for businesses. In this article we shall explain how the endowment effect can affect businesses, as well as recommend a few relevant PowerPoint presentation templates which can help you create presentations to make use of the endowment effect in your marketing strategies.

What is the Endowment Effect?

In behavioral economics, divestiture aversion or the endowment effect refers to the preference of people for retaining an object that they possess, rather than to acquiring the same object when they do not own it. Based on research by psychologists Daniel Kahnerman, Jack Knetsch and Richard Thaler, it was observed that people weighed heavily on losses than they did gains, a concept which is known as ‘loss aversion’, which is also closely linked to the endowment effect.

Since consumers are likely to value the things they own more than acquiring the same thing if they did not own it, businesses use the endowment effect in their marketing strategies to lure customers. For example, you might sign up for a 14 day free trial for a web service. This might give you a sense of ownership for the product, after which you might want to retain your account for the web service. The sense of ownership in this case would encourage the consumer to retain the service, which would not have existed if he/she had to purchase the service without first owning it.

Understanding the Endowment Effect

Understanding the endowment effect can enable entrepreneurs to make more informed business decisions and try to predict consumer behavior based on their preference for ownership. In order to understand the concept in more detail, let’s take a look at a few examples.

Examples of Endowment Effect

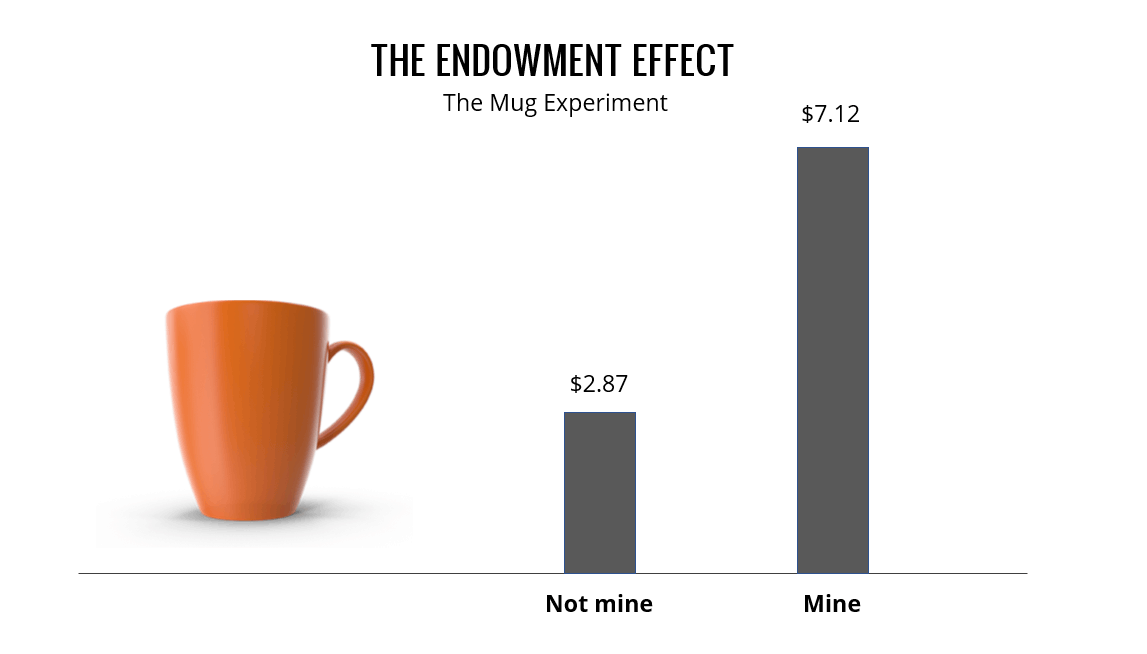

The Mug Experiment

Daniel Kahnerman, Jack Knetsch and Richard Thaler conducted an experiment where participants were given a mug and then given the opportunity to sell their mugs or to trade them for pens, which were deemed equally valuable. They discovered that once people had accepted the mugs and established ownership, the amount participants demanded for selling the mug was twice as high. This was in sharp contrast to the amount they were initially willing to pay to acquire the mug.

The NCAA Tickets Experiment

Researchers Ziv Carmon and Dan Ariely conducted a study titled, ‘Focusing on the Forgone: How Value Can Appear So Different to Buyers and Sellers’. The study tested the hypothetical buying- and selling-price for National Collegiate Athletic Association (NCAA) basketball game tickets. During the study they discovered that the NCAA final four tournament tickets would hypothetically sell 14 times higher than their hypothetical buying price. This means that the willingness to accept (selling price) for the tickets was 14 times more than willingness to pay (buying price). Ziv Carmon and Dan Ariely suggested that due to the endowment effect, people can be hesitant to buy a new product instead of upgrading an existing product. This is why marketing a new product as a replacement can be a more effective marketing strategy.

Endowment Effect and Related Concepts

The above experiments show that people are more likely to retain objects they already own, as compared to acquiring the same object by buying it. This is due to the sense of loss that the owner feels when selling something for which his/her ownership is already established. Someone who already owns a house might be reluctant to sell it as compared to buying a new house. The sense of loss has various reasons associated with it, including a sense of personal attachment and the sense of loss when selling something one owns.

Antitrust scholar Herbert Hovenkamp argues that the endowment effect implies that the individual has no indifference curve, which shows the points where the consumer is indifferent between two products.

Let’s take a look at a few concepts closely related to the endowment effect, in order to better understand consumer behavior and motivations.

Loss Aversion

In a previous post we discussed the prospect theory and loss aversion. Loss aversion refers to people’s preferences of avoiding losses rather than gaining something of equal value. A simple example of loss aversion would be a person’s preference to not lose $3 as compared to finding $3. While the gain is the same, people tend to weigh heavily when they feel a sense of loss, this is something also closely linked to the endowment effect as a non-rational cognitive process which weighs heavily on a sense of loss rather than something of equal value.

Loss Aversion is often used in marketing by providing the potential customer with a sense of gain by averting unlikely losses at an expensive price. Many insurance packages tend to be marketed this way, where consumers might opt for an expensive package thinking they are averting a heavy loss, even though the chance of such a loss might be negligible.

Status Quo Bias

The Status quo bias is a preference for maintaining the status quo. It is an emotional bias which compels one to stick to the current state of affairs. The Status quo bias is associated with other non-rational cognitive processes such as the endowment effect. This is because an individual views the potential loss of breaking the status quo more heavily than opting for change.

For example, consumers can tend to stick with low reliability of products and services to maintain the status quo, instead of opting for a more efficient product or service, simply because of their emotional bias to stick to the current state of affairs.

Psychological Inertia

Another concept linked to the endowment effect is psychological inertia. Unlike the Status quo bias, this is the motivation needed to move on from the status quo. Psychological Inertia is the ability of someone to maintain the status quo unless an intervention motivates the individual to reject it. Psychological inertia is often experienced in change management which results in resistance to change by employees, unless they are motivated to consider the gains of the change in favor of breaking free from the status quo.

For example, an employee might be resistant to change, unless he/she is motivated that the change might improve productivity and raise company revenue which might result in a promised bonus to employees if such a target is achieved.

The Mug Experiment. Source: SlideModel.com

Endowment Effect in E-commerce

The endowment effect in recent years has been heavily leveraged by e-commerce firms. It’s implications for marketing new products and services in e-commerce has been quite effective in the growth of businesses.

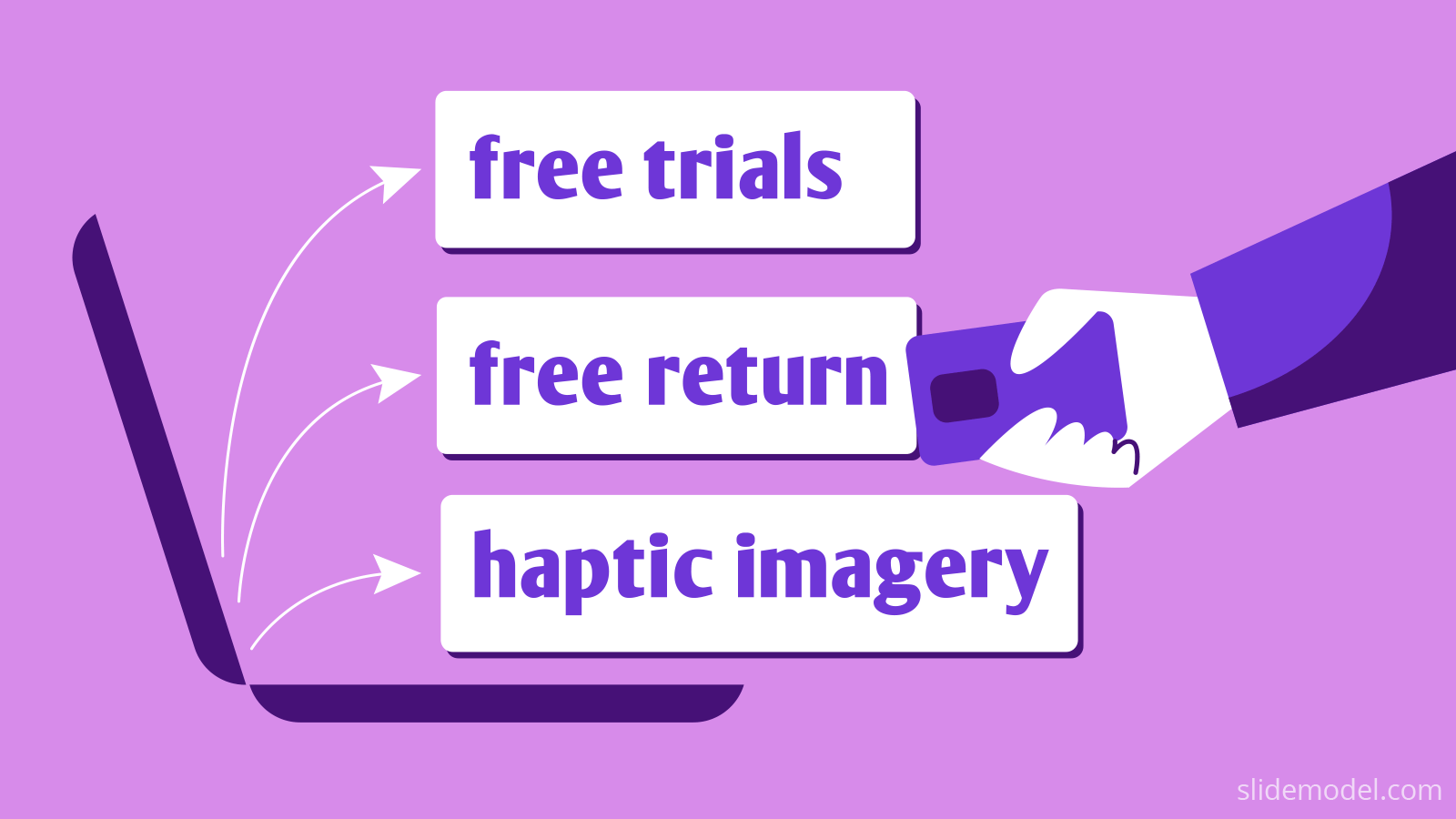

Free Classes and Free Trials:

Many web services and online learning portals offer free trials and free classes to encourage customers to buy their products. A ‘free account’ which might even become redundant after a 14-day trial can have value for a customer, as compared to owning an account by paying a fee. This can compel people to continue with a subscription by making a purchase once the trial period is over. Most of the free classes or trials in such a case are usually of little or no use, since the classes only discuss what the course would be like and trial products often come with limitations such as watermarks and downloading restrictions. Despite this, a sense of ownership encourages people to make a purchase, even though there might be a better service which might not offer the free trial or free classes.

Free Return Policy:

Many e-commerce businesses use a return policy for unsatisfied customers; however, it is unlikely for customers to return a product once they have acquired it. The free return policy creates an effect where the business appears endowing, while not expecting many customers to return products.

Haptic Imagery:

Many e-commerce businesses provide a sense of ownership to customers by showing them how the product might look and feel in their possession. Businesses allow customers to customize their products online using a set of options or show them the ‘best fit’ for their use based on their selected filters to give them a sense of virtual ownership to encourage purchases. In order to market, people no longer need good public speaking skills like Steve Jobs in order to sell a product, as businesses can give consumers a sense of ownership using digital platforms.

IKEA’s Place app lets you see how a product might look at your personal office or home, giving a sense of ownership. Similarly, you can use VR to simulate a room with Wayfair products to see how they might fit into your personal space.

Economic Impact of Endowment Effect

Sometimes people might refuse to sell a house due to their emotional attachment and sense of loss that might result in such a sale. This means that they might even stick with a house which causes more inconvenience as compared to a more comfortable accommodation that they might gain if they sold the house and purchased a new one or moved to a better locality.

The endowment effect is a double-edged sword when it comes to its economic impact. At one end consumers might be reluctant to change and might have to be encouraged through marketing strategies to spend money which can propel an economy. Whereas, overspending by consumers, especially money that they don’t have can result in an economic meltdown! The 2008 U.S. credit crunch was blamed on a culture of consumerism, which resulted in a lending crisis as people were spending money through credit that they found hard to pay back. The consumerism in question can be arguably blamed on the use of the endowment effect by businesses, which lured customers using strategies which encouraged them to own products they didn’t even need or housing they couldn’t afford.

There is a debatable point about the use of the endowment effect in business while considering sustainability. Do consumers really need a new smartphone model every year? How long can companies continue to use the endowment effect in their favor until they inevitably run out of paying customers due to exploiting a culture of consumerism? How many businesses would eventually survive if people continue to see a decline in their purchasing power due to a recession which also has its roots in exploitative business practices using the endowment effect?

Final Words

We can argue that the endowment effect when closely linked to consumerism can result in an economic impact which many businesses might find hard to live with. However, in the wake of the Covid-19 pandemic, it is likely that using the endowment effect effectively would be more important for businesses than ever before. Many businesses have switched tactics by selling a line of products which they had previously not sold, to lure customers and maintain sales. Many food delivery and ride hailing services are now offering home delivery of grocery items, disinfectants, masks and even personal protective gear by using the fear and anxiety of customers afraid to venture outside. Businesses like these try to establish a sense of ownership by showing customers how their home and loved ones would be secure after using such products and why using their service is the perfect way to stay safe. In this case many old fashioned retailers are also switching to e-commerce and marketing tactics which can be closely linked to loss aversion and the endowment effect.

In such a case there is an argument to be made regarding the responsible use of the endowment effect by businesses to sell their products, while not prying on the fears and anxiety of customers but rather building a relationship based on trust and reliability of their products or services. Such businesses are likely to become a part of the status quo bias for people in the near future, who might intend to stick with them as switching might bring forth a sense of loss. Businesses like these might eventually be the ones which may end up making the best use of the endowment effect!