For a consumer, economic decisions are based on certain types of behavior. Prospect Theory or the loss-aversion theory in behavioral economics and behavioral finance, aims to determine people’s decision making and their tendency for loss aversion.

What is Prospect Theory and Loss Aversion?

In 1979, Daniel Kahneman and Amos Tversky came up with the Prospect Theory. The Prospect Theory aims to explain how people choose between different prospects and how they choose the probability of each prospect to avert losses.

The theory uses a reference point to determine how people make decisions. For example, an athlete who wins the silver medal might be unhappy compared to the one who wins the bronze medal. This is because the silver medalist was looking forward to being number one by winning the gold medal. However, the athlete who wins the bronze medal would have one nothing had he lost and become number four.

Prospect Theory essentially claims that we process information in an irrational manner and value gains and losses differently. For example, the gain of $50 is more valuable compared to if you had $50, gained $50 more and lost $50. While in both cases the gain would be $50, the initial gain would seem pleasing, instead of the scenario when you lose $50 out of $100. If you were to look into the loss aversion or aversion definition, it’s more about preferences rather than rational behavior.

Prospect Theory vs. Utility Theory

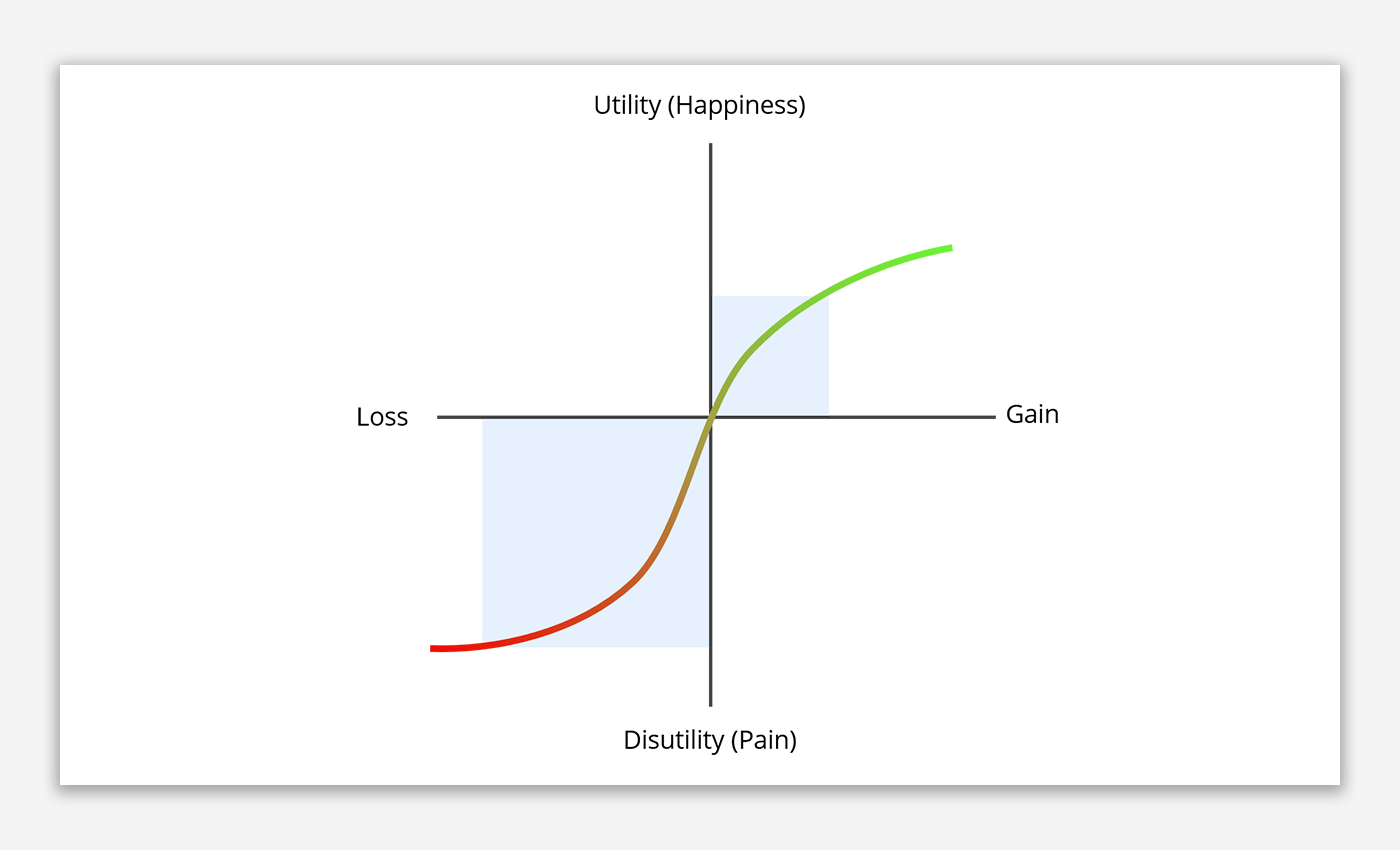

The Prospect Theory challenged the Utility Theory, which was developed in 1944 by John von Neumann and Oskar Morgenstern. The Utility Theory assumes that individuals can rank their preferences in order. The theory explains why people are risk-averse in situations that might lead to a loss. It assumes that everyone is rational and decision making is based on rational thinking. It focuses on the utility gained by individuals based on their decisions. However, the Prospect Theory describes an asymmetric assessment of loss and gain by people. It focuses on an individual’s gains or losses and not the utility derived.

Unlike the Utility Theory, Prospect Theory argues that people might not always be risk-averse and might become risk-seeking in the hope of getting better results. This is a common trend observed in gambling, especially habitual gamblers can tend to be risk-seeking in the hope of better gains. Similarly, many businesses suffering from losses might even invest more money in the business in the hope of better gains in the future.

How Does the Prospect Theory Work?

The Prospect Theory is a good way of determining the actual way people and organizations make decisions. Unlike the Utility Theory; the Prospect Theory uses the reference point to determine how the outcome changes income when compared to the reference point. The reference point can be used for gains and losses to be assessed. A simple way of explaining this is that losses tend to upset investors more than gains tend to make them less upset.

Let’s look at an example regarding investor behavior. If you’re looking to understand your investors, you can determine that they tend to give more weightage to perceived losses as compared to perceived gains. Even when an investor is presented with an equal choice, he/she will choose the choice presented with the most perceived gains. This is because according to the Prospect Theory, the perceived loss would have a larger negative emotional impact.

Understanding how people make decisions based on certainty, isolation effect and loss aversion can be quite valuable. The Prospect Theory has been used to understand the anomalies of the real world which affect market trends, such as the home bias, where investors tend to invest in domestic equities more than foreign equities.

Relative Positioning

People also tend to focus on relative positioning. This means that there is more emphasis on relative gains than the final wealth or income. If a person’s relative position shows no improvement despite a gain in income or wealth, he will not see himself as better off. In other words, one might compare himself to his neighbor or family members, instead of whether he is better off compared to previous years. For example, if everyone gets a raise of 10%, there might not be any gain felt, as compared to if you got a raise of 5% and no one got a raise.

Small Probabilities

People can overlook very small probabilities even if they pose the threat of losing everything. This factor can end up making people choose high probabilities with a high-risk option.

The Three Biases

There are three types of behavior that the Utility Theory fails to explain. This includes; certainty, isolation effect and loss aversion. These concepts are explained in the Prospect Theory.

1. Certainty

People have a bias when it comes to certain options. One would rather be interested in an assured gain which might be less, as compared to the chance of a better gain, the flip side of which might be a zero gain. On the contrary, people tend to take more risks when faced with certain losses. This is because people can be risk-seeking to avert a bigger loss.

For example, you might find an offer of $10 discount for offering feedback for a product attractive, as compared to spending $10 on a coupon for a potential but unlikely reward of a $1000 in a sweepstake.

2. Isolation Effect

People tend to disregard things that are common in both options to simplify their focus on what’s different. Laying out information differently can cause a shift in choices.

For example, a complaint rate of 10% might seem negative as compared to 90% of customer satisfaction. While both represent the same, the latter might seem more attractive to a consumer.

3. Loss Aversion

People look to minimize losses as the loss can be more painful than the gain. This can be a factor in determining consumer preferences and how information is presented before them to drive sales.

For example, insurance companies tend to provide a long list of issues that one might face and offer insurance as a solution. This makes people avert the hefty, yet unlikely loss and forget that they would be spending a regular amount of money on insurance costs.

The Two Phases of Prospect Theory

The Prospect Theory consists of the editing and evaluation phase. Let’s take a look at both these phases in detail.

1. Editing Phase

During the editing phase, people code the prospects offered to them by looking at gains and losses in terms of the reference point. Then, they identify the prospects with identical outcomes, separate the riskless component, and common components are canceled out for each of the offered prospects. This is called the framing effects. The framing effects are the order, wording or method which can affect the choices made by people.

2. Evaluation Phase

The evaluation phase makes use of statistical analysis for risk comparison. There are two indices for this purpose, namely; the value or utility function and the decision weighting function. During the evaluation phase, people act as if they would make a decision based on the highest utility option when considering possible outcomes.

The video below explains the functioning and calculations of the Prospect Theory in detail.

Final Words

Prospect Theory uses psychology to describe the choices people make. It is a psychological theory regarding how people make choices when faced with risky alternatives, uncertainty and probability. The theory explains that people make choices based on perceived losses and gains. Understanding this very simple concept can help people understand anything from consumer preferences to market trends. However, there are also critics of the theory who claim that it does not explain the process in psychological terms, such as the human emotional response in decision making. It is also criticized for having inadequate framing theory.

Despite criticism, the Prospect Theory has played an important role in understanding how people make decisions. It is essential for businesses, as they aim to understand market trends, perceived losses and perceived gains in the eyes of the consumer. Messages that are negatively framed can put off consumers, as compared to messages that can help create a better-perceived gain. Even though the final outcome for both choices might be the same, with literally no difference in the outcome. This is why a 5% rise in salary when no one else gets a raise might be perceived better than a 20% flat salary increase for everyone.

In the digital age, the Prospect Theory is used to understand anomalies and inconsistencies in economic trends. Similarly, the theory has implications in political science to analyze political decision making; such as when determining why certain governments opt for risky welfare reforms while others don’t take that path.

It is likely that the Prospect Theory shall remain relevant for many years to come, perhaps going through an evolutionary phase where it is further refined for a wide range of applications.