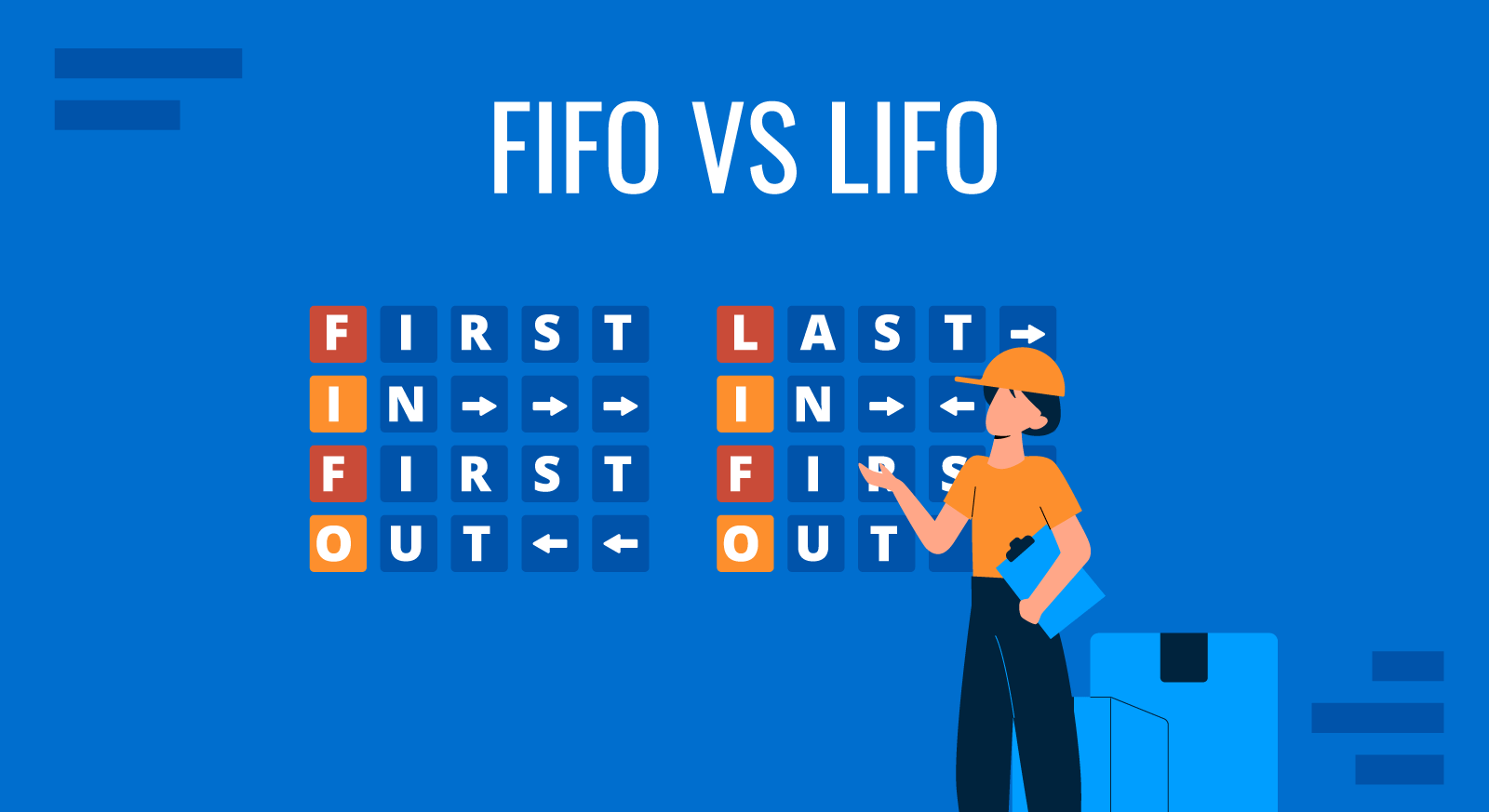

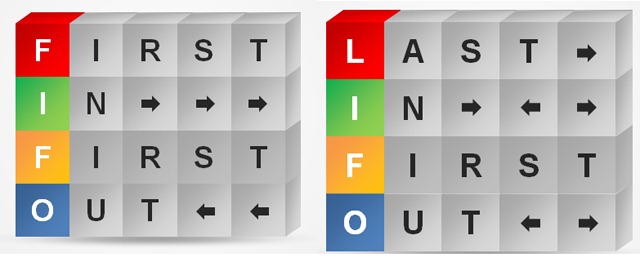

FIFO and LIFO are inventory evaluation methods. FIFO (First in First Out) is meant to use stock based on first unit being sold first, whereas LIFO (Last in First Out) assumes the opposite. Let’s explore these two inventory evaluation methods in detail and see how we can create FIFO and LIFO related reports, diagrams and presentations using PowerPoint Templates.

FIFO — First In First Out

As mentioned earlier, FIFO stands for ‘first-in, first-out’, which means that the oldest inventory items are to be recorded as sold first. This however does not imply that the oldest items were indeed the ones that were sold out first but it’s rather a simple method of accounting for the inventory to evaluate the cost of the balance sheet’.

LIFO — Last In First Out

LIFO or ‘last-in, first-out’ evaluates the inventory items by accounting the recently produced items as sold first. Hence, using LIFO in accounting means that the last unit making its way in the inventory is considered as the item sold first. Some companies may prefer to use this method to reduce their income tax burden during inflationary period; however, LIFO has been banned as per International Financial Reporting Standards.

Impact of LIFO and FIFO Methods on Taxable Income

One of the major reasons why LIFO or FIFO is to be used is inflation. In the absence of inflation both methods would suffice, however, using one method or the other can have a significant impact on taxable income. For example, with stable prices a business entity may be able to produce a good (Good X) at e.g. $1, where the LIFO and FIFO average cost will be a cost of $1 per Good X.

- Using FIFO will give a better idea about the true value of the ending inventory. This will increase the net income which may lead to a higher tax burden.

- Using LIFO on the contrary can result in a misleading inventory value, as the inventory might be very old and even obsolete. This may result in valuing goods lower than the recent prices; leading to a lower net income, as the cost of goods sold will be higher.

Create LIFO and FIFO Diagrams, Presentations and Reports Using PowerPoint Templates

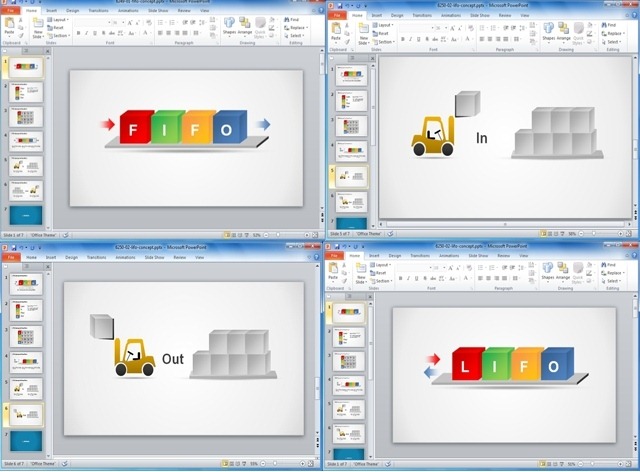

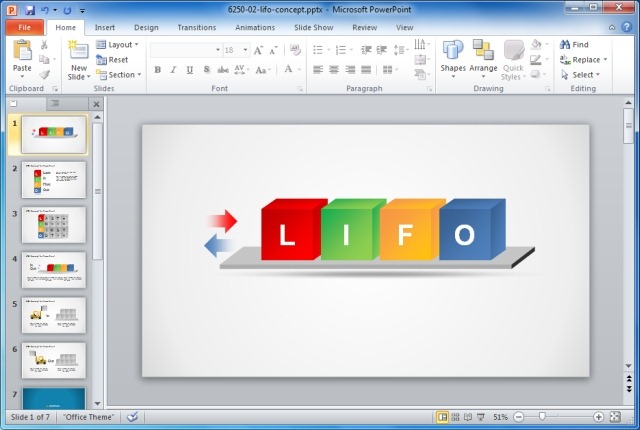

Below are two templates that can be used for creating LIFO and FIFO related presentations, diagrams and reports using PowerPoint.

LIFO PowerPoint Template

The LIFO PowerPoint Template is a set of editable slides that offer layouts for making anything from simple LIFO diagrams and presentation slides to elaborate layouts. The first sample slide provides an image of blocks with ‘LIFO’ written on them, with placeholders for adding the title and sub-title for the presentations. This is followed by more elaborate layouts providing stylish slides for presenting LIFO-related topics, including two sample slides showing a vehicle bringing products in and out, presenting the concept, ‘Last in, Last Out’.

Go to Download LIFO PowerPoint Template

FIFO PowerPoint Template

Like the LIFO template, this template too provides both basic layouts, as well as diagrams and images which can be edited for making slides related to the FIFO concept. This is more like a clone of the LIFO template, with FIFO themed slides. You can even use both these templates to create a single comprehensive presentation about LIFO and FIFO concepts.